ProMantra delivers comprehensive insurance eligibility verification solutions that eliminate coverage uncertainties before treatment begins. Our medical insurance verification specialists validate benefits, confirm active coverage, and identify patient financial responsibilities ensuring accurate reimbursement while patients understand their obligations upfront through transparent health insurance eligibility verification processes.

Get In Touch

Fill out the form below and we'll get back to you as soon as possible.

Clean Claims Rate

Faster AR Resolution

Specialties Served

Patient eligibility verification is the process of confirming a patient’s insurance coverage and benefits before services are rendered. It includes verification of active coverage, benefit confirmation, coverage limitation checks, copay and deductible identification, and coordination of benefits. Effective patient eligibility verification services integrate seamlessly with front-end revenue cycle operations to prevent claim denials, reduce payment delays, and ensure accurate reimbursement from the start.

Effective patient eligibility verification services prevent claim denials, reduce payment delays, and ensure providers collect accurate patient responsibility amounts upfront. With insurance plans constantly changing and coverage rules becoming more complex, robust verification processes help providers avoid costly rejections, improve collections, and maintain financial predictability. Ultimately, reliable patient eligibility verification services strengthen revenue capture, support efficient scheduling workflows, and enhance overall financial performance from the first point of contact.

Healthcare organizations face shrinking margins, increasing patient financial responsibility, and complex multi-payer environments. Modern patient eligibility verification services are essential to capture revenue accurately and maintain financial health in this demanding landscape. By strengthening verification processes, providers can reduce bad debt, improve patient experiences, and stay financially sustainable in today’s healthcare environment.

Maximize revenue, reduce denials, and accelerate payments with our proven RCM solutions. We deliver measurable results backed by 23+ years of expertise.

Outsourcing insurance verification services eliminates staffing costs, training expenses, and technology investments associated with in-house operations. Specialized partners deliver comprehensive medical insurance verification at predictable rates, reducing overhead while maintaining quality standards that internal teams struggle to achieve consistently.

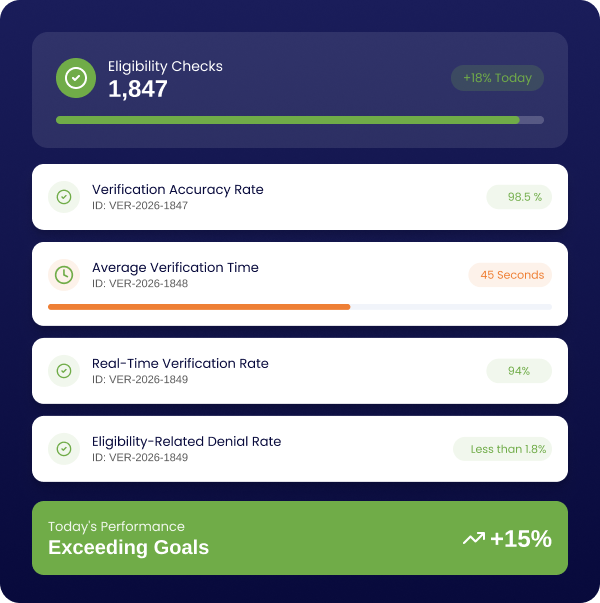

Dedicated verification specialists utilizing advanced technologies achieve 98%+ accuracy rates in patient eligibility verification significantly exceeding typical in-house performance. Their focused expertise and sophisticated payer connectivity ensure precise benefit validation through systematic insurance eligibility verification, dramatically reducing denials that compromise cash flow.

Professional insurance verification services provide rapid turnaround times, often completing medical insurance eligibility verification within hours rather than days. Real-time payer connections deliver instant coverage confirmations, enabling same-day appointments without delays while ensuring accurate financial counseling before service delivery begins.

Outsourced health insurance eligibility verification solutions scale effortlessly with your organization's growth, handling volume fluctuations without hiring challenges or capacity constraints. Whether managing 100 or 10,000 monthly verifications, specialized insurance verification services adjust resources dynamically, maintaining consistent service levels.

Our patient eligibility verification process follows systematic protocols: receiving patient demographics and insurance information, validating coverage through multiple payer sources, documenting benefit details and limitations, calculating financial responsibilities, and delivering comprehensive medical insurance verification reports to your team within committed timeframes.

We maintain direct electronic connections with major insurance carriers, enabling instant insurance eligibility verification through secure EDI transactions. Our system queries payers automatically, retrieving current coverage status, benefit levels, copayment amounts, deductible balances, and authorization requirements delivering real-time health insurance eligibility verification accuracy.

Our specialists analyze complicated coverage scenarios including secondary insurance, Medicare Advantage plans, managed care requirements, and coordination of benefits situations. We interpret intricate policy language through detailed medical insurance verification, identify coverage exclusions, determine medical necessity criteria, and clarify authorization protocols.

Every patient eligibility verification generates detailed documentation capturing coverage confirmation, benefit summaries, financial responsibility breakdowns, and relevant policy limitations. Reports from our insurance verification services integrate seamlessly with your practice management system, providing immediate access to verified medical insurance eligibility verification information.

ProMantra's insurance eligibility verification services increase patient collections by 20-30% through accurate upfront financial counseling. By identifying patient responsibilities before service delivery through comprehensive medical insurance verification, we enable effective payment discussions, establish payment plans when needed, and reduce bad debt significantly across surgical, diagnostic, and therapeutic specialties.

Our verification accuracy eliminates 40-60% of eligibility-related denials that delay reimbursement. Clean claims submission rates improve dramatically when patient eligibility verification confirms coverage details, authorization status, and benefit levels accurately through thorough health insurance eligibility verification, accelerating payment cycles while reducing expensive appeals and resubmission work.

Streamlined verification workflows reduce patient wait times and registration bottlenecks significantly. Our team completes insurance eligibility verification before scheduled appointments, enabling smooth check-in experiences without lengthy insurance discussions. Coverage errors drop by 75% through reliable medical insurance eligibility verification, creating efficient patient flow that improves satisfaction.

Healthcare organizations who have partnered with ProMantra for insurance verification services document measurable results: 15-25% reduction in accounts receivable days, 98.5% verification accuracy rates, 30% decrease in claim rework, and improved staff productivity. Our comprehensive reporting provides transparent metrics demonstrating ROI directly attributable to enhanced patient eligibility verification processes.

Partner with ProMantra to enhance efficiency, reduce costs, and boost cash flow through optimized revenue cycle management.

Deep knowledge of specialty-specific coding, compliance requirements, and payer rules to maximize your reimbursements

Need a custom RCM solution?

We serve 45+ medical specialties - Contact us to learn more

Connect with Our Team

Submit your details and we’ll reach out to assist you.

Real metrics from real healthcare organizations we've helped transform

98.5%

Clean Claims Rate

30–40%

Faster AR Resolution

45+

Specialties Served

23+

Years RCM Expertise

200+

Healthcare Organizations Served

$2.5B+

Annual Revenue Managed

99.5%

Client Retention Rate

See how we’ve helped healthcare organizations like yours achieve measurable revenue growth

Multi-Specialty Hospital

Please fill out the form below to download the case study.

Surgery Centre

Please fill out the form below to download the case study.

Surgical Centre with Lab Services

Please fill out the form below to download the case study.

After a bad experience with another billing company, I was hesitant to outsource again. ProMantra completely changed my perspective. Within three months, our clean claim rate jumped from 87% to 96%, and our days in AR dropped significantly. My office manager now focuses on patient care instead of billing headaches. The transparency and expertise they bring have transformed our practice finances. This is the best company for RCM services.

Orthopedic billing is incredibly complex, and we were leaving money on the table with coding errors and missed modifiers. ProMantra's specialized knowledge made an immediate impact on our collections, improving by 28% in the first year, and denials dropped from 12% to under 4%. Their authorization team prevents denials before they happen. I can finally focus on surgery while they handle the financial complexities with true expertise.

Managing billing for eight cardiologists was consuming our resources and affecting profitability. ProMantra reduced our AR from 68 to 41 days within six months and improved our authorization approval rate to 94%. The cost savings compared to in-house staff, combined with better results and real-time reporting, made this decision invaluable. Their dedicated support and responsiveness set them apart from any billing partner we've worked with.

Mental health billing has unique challenges that most billers don't understand. ProMantra reduced our claim rejections from 15% to under 3% and helped us implement documentation practices that reduced audit risk. The financial improvement allowed us to hire another therapist and serve more patients. My clinicians are less stressed, and we're making a bigger impact in our community thanks to their behavioral health expertise.

I was handling my own billing to save money and nearly couldn't make payroll for one month. ProMantra found over $47,000 in unpaid claims and recovered $38,000 I thought was lost. My monthly revenue increased by 35%, and I spend evenings with my family instead of fighting insurance companies. They gave me my life back while making my practice significantly more profitable. I recommend ProMantra for any RCM Services.

ProMantra's revenue cycle management services are designed to support healthcare providers across the spectrum, from solo practitioners to large health systems. Our scalable solutions adapt to your organization's size, specialty, and unique requirements.

RCM companies partner with experienced revenue cycle teams to scale operations and deliver reliable results to their clients. Support across coding, billing, AR, and denial management helps manage higher volumes, reduce operational costs, and maintain accuracy while meeting strict SLAs and compliance standards.

Solo practitioners and small group practices benefit from our cost-effective RCM services that provide enterprise-level capabilities without the overhead. We help independent practices compete effectively by optimizing their revenue cycle and reducing administrative burden.

Large group practices with multiple specialties appreciate our ability to handle diverse coding requirements and payer relationships. Our centralized approach provides consistency while accommodating specialty-specific needs, including complex insurance contracting.

Hospital-based practices and health systems leverage our expertise in complex billing scenarios, including facility and professional fee billing. We understand the unique challenges of hospital RCM and provide solutions that integrate with existing systems, focusing on revenue integrity and acuity capture.

Whether you are in cardiology, orthopedics, gastroenterology, dermatology, or another specialty, our team includes certified coders and billing specialists with deep expertise in your field. We understand the nuances of specialty billing and maintain current knowledge of specialty-specific regulations and requirements.

High-volume, challenging environments like urgent care centres benefit from our efficient processing capabilities and real-time eligibility verification. We help these practices maintain quick patient throughput while ensuring accurate billing and collections, including efficient supply billing processes.

Clinical and reference laboratories benefit from our specialized expertise in navigating complex test ordering and billing workflows. We handle the intricacies of panel billing, medical necessity documentation, and compliance with evolving PAMA requirements. Our team ensures accurate claim submission for diverse test portfolios while managing multiple ordering physician relationships and maintaining optimal reimbursement rates.

Imaging and diagnostic centres leverage our comprehensive understanding of technical component billing and authorization management. We streamline prior authorization workflows, optimize CPT code selection for various modalities, and manage the complexities of bundled and split-billing scenarios. Our specialized approach ensures timely reimbursement while maintaining compliance with facility-specific billing regulations and payer-specific imaging policies.

Partner with ProMantra to enhance efficiency, reduce costs, and boost cash flow through optimized revenue cycle management.

Healthcare providers consistently choose ProMantra for our revenue cycle management services because we deliver results that directly impact their bottom line. Our client retention rate exceeds 98%, reflecting the value and satisfaction our services provide.

With over 23+ years in healthcare revenue cycle management, we have helped hundreds of practices improve their financial performance. Our experience spans multiple specialties, practice sizes, and geographic regions, giving us insights that benefit all our clients.

Our proprietary technology platform provides real-time visibility into your revenue cycle performance. Advanced analytics help identify trends and opportunities, while automated workflows reduce manual errors and improve efficiency. Our platform integrates with over 50 EHR and practice management systems, ensuring seamless data flow and improved charge capture.

Each client is assigned a dedicated account manager who understands your practice's unique needs and challenges. Our support team is available during business hours for questions and issues, with emergency support available 24/7 for critical situations.

We provide detailed monthly reports that give you complete visibility into your revenue cycle performance. Our reports include key metrics, trend analysis, and actionable recommendations for improvement. You will always know exactly how your revenue cycle is performing, including your clean claims ratio and net collection rate.

Whether you are a solo practitioner or a large health system, our RCM services scale to meet your needs. As your practice grows, our services grow with you, providing consistent support and performance regardless of your size.

Our RCM services typically cost less than maintaining an in-house billing department while delivering superior results. Most clients see a positive return on investment within the first three months of partnership, with significant improvements in their collection rate and overall revenue integrity.

Stop leaving revenue on the table. Partner with ProMantra and experience the difference that expert revenue cycle management makes

Prefer to talk to someone?

Complete the form and our RCM experts will contact you within 24 hours

Find answers to common questions about our RCM services and how we can help your practice

Patient eligibility verification is the process of confirming a patient's active insurance coverage, benefit details, and financial responsibilities before healthcare services are rendered. It's critical because medical insurance verification prevents claim denials, reduces bad debt, ensures proper reimbursement, and provides patients with accurate cost information upfront, establishing financial transparency that improves collections.

Turnaround times vary based on complexity and payer responsiveness. Standard medical insurance eligibility verification is typically completed within 24-48 hours, while urgent same-day requests can be processed in 2-4 hours through real-time electronic payer connections. High-volume practices benefit from batch processing that delivers health insurance eligibility verification results before scheduled appointment times.

Essential information includes the patient's full name, date of birth, insurance carrier name, policy/member ID number, group number (if applicable), and subscriber's information if the patient is a dependent. Additional details like Social Security number may be requested for complex medical insurance verification cases or when payers require enhanced identification for accurate patient eligibility verification.

Verification confirms active coverage and benefit details at the time of inquiry but doesn't guarantee payment. Claims can still be denied for reasons like medical necessity, incorrect coding, or policy exclusions. However, thorough patient eligibility verification significantly reduces eligibility-related denials and helps identify potential coverage issues before services are provided through comprehensive medical insurance verification processes.

Outsourced insurance verification services provide specialized expertise, advanced technology, dedicated resources, and consistent accuracy that most in-house teams cannot match cost-effectively. External partners handle volume fluctuations seamlessly with medical insurance eligibility verification, maintain updated payer knowledge, and deliver faster turnaround times without requiring your staff investment in training or technology.

Absolutely. Insurance eligibility verification services cover all insurance types including Medicare (Parts A, B, C, D), Medicaid, Medicare Advantage plans, commercial insurance, and managed care organizations. Specialists understand the unique requirements, coverage rules, and health insurance eligibility verification procedures specific to government programs and apply appropriate protocols for each payer type.

When medical insurance verification reveals inactive coverage or lapsed policies, providers receive immediate notification before services are rendered. This allows staff to discuss payment options with patients, explore alternative coverage, reschedule non-urgent services, or establish self-pay arrangements through insurance verification services preventing revenue loss and awkward financial discussions after treatment completion.

Best practice recommends verifying eligibility before every appointment or service, as coverage status changes frequently due to job changes, policy terminations, or benefit modifications. For recurring patients, patient eligibility verification should occur at minimum monthly or when scheduling new appointments. Inpatient admissions require medical insurance eligibility verification at admission and periodic re-verification for extended stays.

Yes, eligibility verification workflows can be tailored to specialty-specific requirements such as imaging, surgery, behavioral health, or DME services. Each specialty has unique coverage rules, authorization needs, and benefit limitations. Customized medical insurance verification improves accuracy and reduces specialty-specific denials.

Yes, eligibility verification is essential for recurring and long-term care, as insurance benefits and coverage can change mid-treatment. Regular medical insurance verification ensures continued coverage accuracy and avoids unexpected claim rejections. This is especially critical for therapy, dialysis, oncology, and chronic care services.

Partner with ProMantra to enhance efficiency, reduce costs, and boost cash flow through optimized revenue cycle management.