Handling billing and reimbursements can be tricky for DME and HME providers. That’s why a solid revenue cycle management (RCM) strategy is key—it helps with everything from handling insurance claims to reducing denials.

This guide simplifies DME and HME RCM, giving you practical tips to simplify billing and boost revenue.

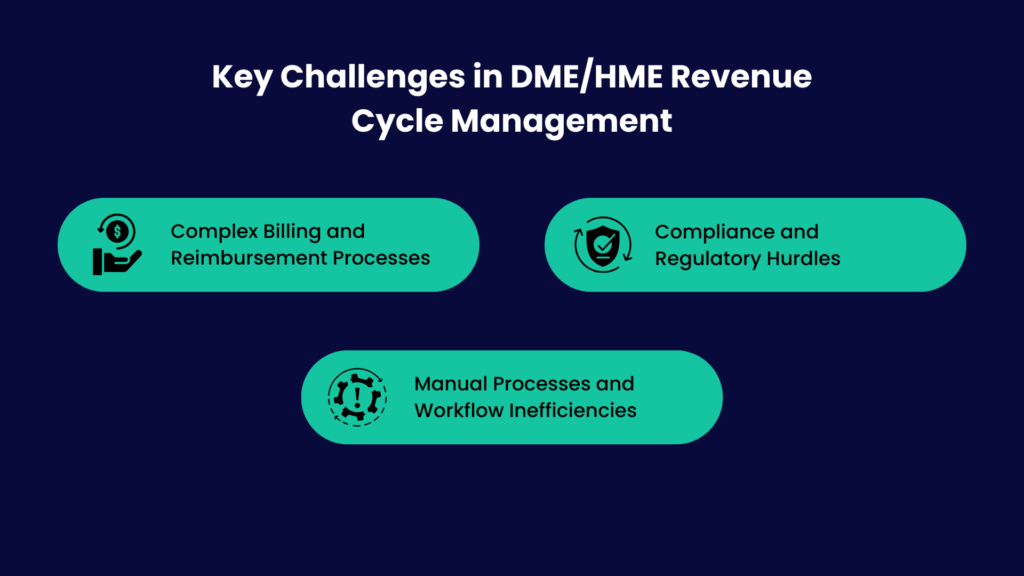

Key Challenges in DME/HME Revenue Cycle Management

Managing DME and HME revenue cycle management comes with its fair share of roadblocks. Here are the top challenges providers face:

1. Complex Billing and Reimbursement Processes

Managing DME RCM means juggling different payer requirements, strict documentation rules, and constant policy changes. Even small mistakes can lead to claim denials, slowing down reimbursements and affecting cash flow.

2. Compliance and Regulatory Hurdles

With evolving Medicare, Medicaid, and private insurance regulations, staying compliant is a constant challenge. Missing even a small detail in HME DME billing can lead to audits, fines, or claim rejections, making regulatory adherence critical.

3. Manual Processes and Workflow Inefficiencies

A lot of providers still use outdated, manual processes that drag down efficiency. Without automation in DME revenue cycle management, errors pile up, claims get delayed, and admin work increases—ultimately cutting into profitability.

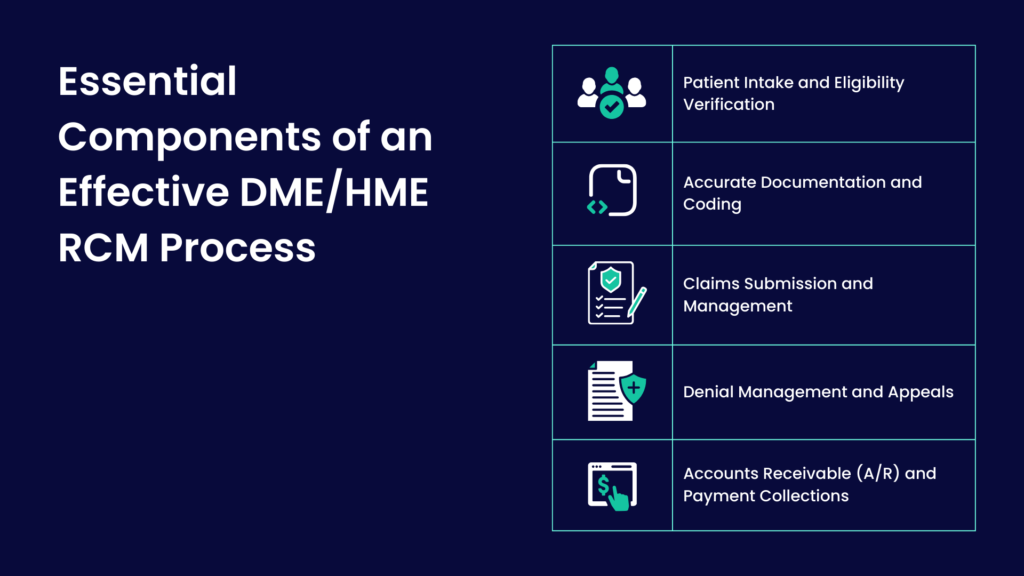

Essential Components of an Effective DME/HME RCM Process

A well-structured DME revenue cycle management process is key to improving cash flow and reducing claim denials. Here’s a breakdown of the critical components:

1. Patient Intake and Eligibility Verification

Why Real-Time Eligibility Checks Matter – Checking insurance coverage upfront saves you from last-minute surprises. With real-time eligibility checks, you can confirm that services are covered before supplying any equipment.

Cutting Down Claim Denials with Accurate Documentation – Missing or incorrect patient details can lead to denied claims. Keeping thorough documentation—like physician orders and proof of medical necessity—helps minimize errors and ensures smoother approvals.

2. Accurate Documentation and Coding

Good documentation is the backbone of smooth DME billing. It keeps claims moving, helps you stay on the right side of payer rules, and lowers the risk of audits or payment delays. Without it, even legit claims can hit snags, causing unnecessary headaches.

The same goes for medical coding—getting HCPCS and ICD-10 codes right is key to avoiding denials. A small mistake can slow things down, so staying updated with regular training makes all the difference. The better your coding game, the fewer problems you’ll run into.

3. Claims Submission and Management

Simple mistakes, such as missing details, wrong modifiers, or duplicate claims, are some of the biggest reasons for denials.

A quick double-check before submitting can save a lot of trouble, and using automated billing tools makes it even easier to catch errors before they cause delays.

Automation is your best friend if you want to speed up claims processing. Batch processing and following payer-specific guidelines help get approvals faster, meaning fewer holdups and quicker reimbursements. The smoother the process, the better your cash flow.

4. Denial Management and Appeals

Root Cause Analysis of Denied Claims – Tracking and analyzing denial trends helps identify recurring issues, allowing providers to address them proactively.

Best Practices for Successful Appeals – A structured appeals process with timely follow-ups, detailed justifications, and supporting documents increases the chances of overturning denied claims.

5. Accounts Receivable (A/R) and Payment Collections

Keeping a close eye on A/R aging reports and tackling overdue accounts early can make a big difference in speeding up reimbursements. The faster you follow up, the quicker you get paid, keeping cash flow steady.

Flexibility is key when it comes to patient payments. Offering payment plans, digital payment options, and friendly reminders can help patients stay on top of their bills, reduce outstanding balances, and improve collections.

Regulatory Compliance in DME/HME Billing

Staying compliant with ever-evolving regulations is crucial for DME and HME service providers to avoid claim denials, audits, and penalties. Here are two key areas to focus on:

1. Understanding CMS Guidelines and Medicare/Medicaid Compliance

The Centers for Medicare & Medicaid Services (CMS) has strict billing guidelines for DME and HME providers. Compliance requires:

- Proper documentation of medical necessity

- Accurate use of HCPCS codes and modifiers

- Adhering to Medicare’s competitive bidding program and reimbursement policies

- Regular training and audits help providers stay updated and avoid costly errors.

2. Ensuring HIPAA and Data Security Standards

Protecting patient health information (PHI) is a legal and ethical responsibility. Compliance with HIPAA regulations ensures:

- Secure handling and transmission of patient data

- Proper access controls to prevent unauthorized use

- Regular risk assessments to mitigate data breaches

Implementing secure billing software and staff training strengthens data security and regulatory adherence.

The Role of Technology in Optimizing DME/HME RCM

Technology is crucial in streamlining DME revenue cycle management, reducing errors, and improving financial performance. Here’s how innovation is transforming the process:

1. Cloud-Based HME/DME Billing Software & Automation

Modern cloud-based billing solutions eliminate the need for manual processes, reducing errors and improving efficiency. Automation ensures faster claim submissions and better financial outcomes.

- Reducing Administrative Burden with AI & Automation – Automated billing software minimizes manual data entry, reducing errors and speeding up claim submissions. AI-powered tools also help flag potential denials before submission, improving approval rates.

- How Integrated Systems Improve Workflow Efficiency: Connecting EHRs, billing platforms, and payer portals ensures seamless data exchange, reduces redundancies, and improves claim tracking. This integration leads to faster reimbursements and fewer processing delays.

2. Leveraging Data Analytics for Financial Decision-Making

Making decisions based on data helps DME and HME providers stay ahead when it comes to collections and revenue.

By monitoring financial trends, you can spot issues early, fix slowdowns, and keep cash flowing without surprises.

- Using Data Insights to Reduce Claim Denials and Increase Collections – Advanced analytics help identify patterns in denials, allowing providers to adjust documentation and billing practices proactively. This leads to improved claim success rates.: and improving

- Revenue Forecasting and Performance Tracking – Data-driven insights enable providers to track key RCM metrics, forecast revenue trends, and make informed financial decisions to maintain profitability.

Benefits of Outsourcing DME/HME RCM Services

Managing DME and HME revenue cycles alone can be overwhelming and time-consuming. Outsourcing RCM services removes the pressure, helping you run things more efficiently, stay compliant, and improve cash flow.

1. When and Why to Outsource RCM

Providers often face high denial rates, strict regulations, and mounting administrative tasks.

When claim delays slow down cash flow or compliance becomes too tricky to manage in-house, outsourcing can be a smart move to keep operations running smoothly.

2. Cost Efficiency, Compliance, and Revenue Growth Benefits

- Cost Efficiency—Outsourcing eliminates the need for extensive in-house billing teams, reducing overhead costs while ensuring expert claim handling.

- Regulatory Compliance – Third-party RCM providers stay updated on evolving Medicare, Medicaid, and HIPAA regulations, minimizing compliance risks and audit issues.

- Revenue Growth – With optimized claim submissions, denial management, and A/R collections, outsourcing RCM leads to faster reimbursements, fewer denials, and improved cash flow.

Summing Up

Managing DME and HME revenue cycles the right way is key to keeping finances stable, staying compliant, and providing better patient care.

With the help of automation, data insights, and outsourced RCM services, providers can cut down on claim denials, speed up reimbursements, and keep revenue flowing smoothly.

A solid RCM strategy makes day-to-day operations more efficient and lets providers focus on what really matters—delivering top-notch healthcare.

Why Choose Promantra for Your DME/HME RCM Needs?

At Promantra, we specialize in providing end-to-end DME and HME RCM solutions tailored to streamline your billing, compliance, and collections.

With a team of industry experts and cutting-edge technology, we help reduce claim denials, improve cash flow, and ensure regulatory compliance.

Partner with Promantra today and experience seamless RCM operations that drive revenue growth! Contact us now to learn how we can optimize your DME/HME billing and revenue cycle management.