Ever wondered how hospitals and healthcare providers ensure they get paid for the services they deliver? It all boils down to a critical process known as Revenue Cycle Management (RCM).

What is RCM?

RCM is the backbone of a healthcare organization’s financial health. It encompasses the entire process of managing patient billing and collecting revenue for services rendered. This includes everything from scheduling appointments and verifying insurance eligibility to coding procedures, submitting claims, and following up on unpaid balances.

Importance of RCM in Healthcare

An efficient RCM system is crucial for healthcare providers for several reasons:

- Financial Stability: Proper RCM ensures timely and accurate reimbursement for services, leading to a steady cash flow that supports patient care and operational costs.

- Improved Efficiency: Streamlined RCM processes minimize administrative burdens and allow staff to focus on delivering quality care.

- Reduced Costs: RCM helps identify and address billing errors or denials, preventing revenue loss and minimizing the need for costly rework.

- Enhanced Patient Experience: Clear and accurate billing communication fosters better patient understanding and reduces billing-related frustrations.

By effectively managing their RCM, healthcare providers can ensure financial viability, improve operational efficiency, and ultimately, dedicate more resources to what matters most – delivering excellent patient care.

Why ROI from RCM Matters?

Return on Investment (ROI) is a key metric that measures the financial benefits of implementing an RCM system or initiative. It essentially calculates the net profit gained from an RCM investment compared to the initial costs.

Here’s why ROI is crucial in RCM:

- Financial Health Assessment: ROI provides a clear picture of how effectively RCM investments are translating into financial gains. This allows healthcare providers to make informed decisions about resource allocation and identify areas for potential improvement.

- Operational Efficiency Evaluation: Analysing ROI helps assess the impact of RCM processes on overall operational efficiency. By measuring the cost of collecting revenue versus the revenue collected, you can determine if RCM is streamlining processes and reducing administrative burdens.

- Justification for Investment: ROI data can be a powerful tool when advocating for new RCM technologies or personnel. By demonstrating the positive financial impact of RCM investments, you can secure necessary resources to optimize revenue cycle management.

While ROI is undoubtedly a valuable metric, it’s important to remember what we discussed earlier – it’s not the sole indicator of RCM success.

Understanding RCM ROI

This section dives deeper into how to measure ROI specifically for RCM initiatives.

Basic ROI Calculation

Calculating ROI for RCM involves a straightforward formula:

ROI = (Total Revenue Generated from RCM Efforts) / (Total RCM Expenses)

Here’s a breakdown of the formula:

- Total Revenue Generated from RCM Efforts: This includes all revenue collected through your RCM processes, such as payments from insurance companies and patients for services rendered.

- Total RCM Expenses: This encompasses all costs associated with RCM, including:

- Personnel costs (salaries and benefits for billing staff, coders, etc.)

- Technology costs (software subscriptions, hardware maintenance)

- Training costs

- Outsourcing fees (if applicable)

- Personnel costs (salaries and benefits for billing staff, coders, etc.)

By calculating ROI, you gain a clear understanding of the financial return you’re receiving on your RCM investment.

Importance of Accurate Calculations:

It’s crucial to ensure accurate data when calculating RCM ROI. Inaccurate figures can lead to misleading results and hinder informed decision-making. Here are some tips for ensuring accurate ROI calculations:

- Clearly define the scope of your RCM efforts: Determine the specific RCM initiatives or investments you’re measuring ROI for.

- Gather accurate and complete data: Ensure you have access to reliable data on both RCM revenue and expenses.

- Consider additional factors: While ROI provides a valuable financial snapshot, remember it doesn’t encompass all aspects of RCM performance. We’ll explore other key metrics in the next section.

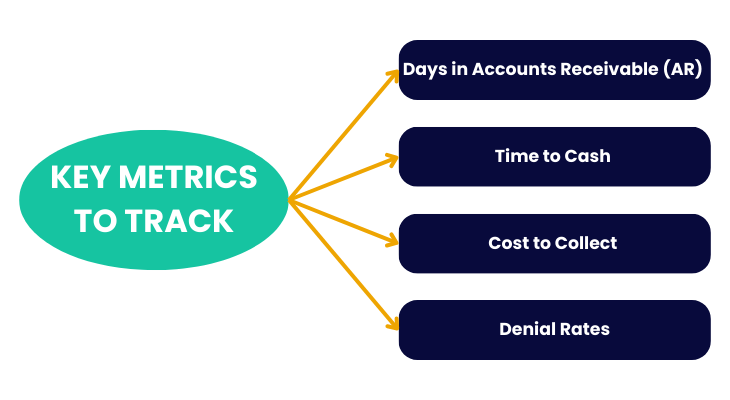

Key Metrics to Track

While ROI is a valuable metric, a comprehensive RCM performance evaluation requires tracking additional key indicators. Here are some crucial metrics to consider, along with how they can be improved through automation technologies like Revenue Cycle Automation (RPA) and Artificial Intelligence (AI):

1. Days in Accounts Receivable (AR)

Definition: This metric reflects the average time it takes for a healthcare provider to receive payment after services are rendered. High AR days indicate slow cash flow.

Impact on Cash Flow: A high AR days figure translates to a longer wait for revenue, impacting cash flow and potentially hindering the ability to invest in essential resources or services.

Improvement Strategies:

- RPA: Automating tasks like patient statement generation and sending timely reminders can significantly reduce AR days.

- AI: AI can predict potential payment delays and enable proactive intervention to collect payments faster.

2. Time to Cash

Definition: This metric measures the entire duration of the revenue cycle, from service delivery to collecting payment.

Efficiency of Billing Process: A shorter time to cash signifies a more efficient billing process with fewer delays and rework.

Improvement Strategies:

- RPA: Automating tasks like insurance claim submission and follow-up reduces processing time and accelerates cash flow.

- AI: AI can identify and address errors in claims before submission, preventing rejections and delays.

3. Cost to Collect

Definition: This metric refers to the expenses incurred in collecting payments from patients and insurance companies.

Measuring Operational Costs: A high cost to collect indicates inefficient collection processes that eat into profits.

Improvement Strategies:

- RPA: Automating manual collection tasks like sending follow-up letters and phone calls minimizes labour costs.

- AI: AI can predict patient payment behaviour and prioritize collection efforts for high-risk accounts, ensuring resources are used effectively.

4. Denial Rates

Definition: This metric reflects the percentage of insurance claims denied by payers.

Reducing Claim Denials and Rework: High denial rates lead to lost revenue and require time-consuming rework to rectify errors.

Improvement Strategies

- RPA: Automating tasks like insurance eligibility verification and claim scrubbing reduces errors and prevents denials due to missing information.

- AI: AI can analyse historical data to identify patterns in denied claims and predict potential issues, allowing for proactive claim correction.

By tracking these key metrics and leveraging automation technologies like RPA and AI, healthcare providers can gain valuable insights into RCM performance, identify areas for improvement, and optimize their revenue cycle for greater efficiency and financial success.

The Role of AI in RCM

Building upon the previous section, let’s delve deeper into the transformative role of Artificial Intelligence (AI) in RCM.

Enhanced Efficiency

AI can automate many tedious and time-consuming tasks within the revenue cycle, significantly improving efficiency. For example, AI can:

- Automate data entry and coding: Extracting information from patient charts and medical records, reducing human error and streamlining coding processes.

- Predict and address denials: Analyzing historical data to identify patterns in denied claims and proactively correct errors before submission.

- Prioritize collections efforts: Predicting patient payment behavior allows for targeted collections activities, maximizing revenue recovery.

Automation of Regulatory Changes

The healthcare industry is subject to frequent regulatory updates. AI can automate tasks like monitoring changes and updating coding practices, ensuring compliance and minimizing disruptions to workflow.

Cost Savings

By automating manual tasks and reducing errors, AI can significantly reduce RCM costs. This includes:

- Reduced labor costs: Automating repetitive tasks frees up staff for higher-value activities.

- Minimized rework: AI-powered claim scrubbing helps prevent errors before submission, leading to fewer denials and costly rework.

- Improved revenue capture: AI can identify missed billing opportunities and ensure accurate and timely claims submission.

Increased Productivity

By automating routine tasks, AI empowers RCM staff to focus on more complex and strategic activities. This can lead to:

- Improved patient interactions: Staff can dedicate more time to resolving patient billing inquiries and providing exceptional service.

- Enhanced focus on quality: With less time spent on mundane tasks, staff can focus on maintaining high-quality coding and claim submissions.

- Strategic decision making: AI can provide valuable data insights that can inform strategic decisions related to RCM optimization.

Overall, AI in RCM offers a powerful opportunity to enhance efficiency, reduce costs, and boost productivity, ultimately leading to a more optimized and financially sound revenue cycle.

Outsourcing RCM: A Strategic Option for Optimized Revenue Cycle Management

In addition to leveraging technology like AI and automation, healthcare providers can explore outsourcing their RCM (revenue cycle management) needs as a strategic option to optimize financial performance. Partnering with a reputable RCM outsourcing company offers several advantages that can enhance efficiency, reduce costs, and free up internal resources for core patient care activities.

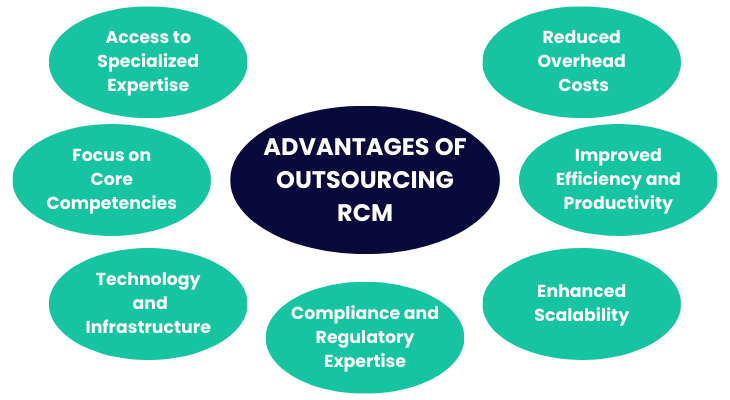

Advantages of Outsourcing RCM

- Access to Specialized Expertise (SEO Keyword: RCM Experts): Outsourcing RCM connects you with a team of experienced professionals dedicated solely to revenue cycle management. They possess in-depth knowledge of complex billing and coding practices, ensuring accurate claims submission and maximizing reimbursement. This expertise can be invaluable for smaller practices or those lacking dedicated RCM staff.

- Reduced Overhead Costs: Managing an in-house RCM team entails significant overhead costs, including salaries, benefits, training, and technology infrastructure. Outsourcing eliminates these expenses, converting fixed costs into a variable expense based on the agreed-upon service level. This allows for greater financial flexibility and potentially reduces overall RCM expenses.

- Improved Efficiency and Productivity: RCM outsourcing companies are equipped with streamlined processes and technology to handle high volumes of claims efficiently. This frees up your internal staff to focus on core patient care activities, leading to improved overall productivity and patient satisfaction.

- Enhanced Scalability: Outsourcing allows you to scale your RCM capabilities easily to accommodate fluctuations in patient volume or service offerings. You don’t need to invest in additional staff or infrastructure as your needs grow.

- Compliance and Regulatory Expertise: The healthcare landscape is subject to frequent regulatory updates and coding changes. RCM outsourcing companies stay current on these regulations, ensuring your practice remains compliant and avoids potential penalties or delays in reimbursement.

- Technology and Infrastructure: RCM vendors have access to advanced technology and infrastructure specifically designed for efficient revenue cycle management. This can include automated claim scrubbing, denial management tools, and real-time reporting dashboards. You can leverage these capabilities without the need for significant upfront investment.

- Focus on Core Competencies: By outsourcing RCM, you can free up your team to focus on core competencies like patient care, provider satisfaction, and practice growth. This allows you to optimize resource allocation and prioritize patient-centric goals.

Choosing the Right RCM Outsourcing Partner

It’s crucial to select a reliable and experienced RCM outsourcing partner to maximize the benefits discussed above. Here are some key factors to consider:

- Industry Experience: Look for a partner with a proven track record of success in your specific healthcare industry.

- Security and Compliance: Ensure the outsourcing company prioritizes data security and adheres to relevant HIPAA regulations.

- Technology and Infrastructure: Evaluate their technology stack and infrastructure to ensure it aligns with your needs and facilitates efficient communication.

- Scalability and Flexibility: Choose a partner with the ability to scale their services as your practice grows.

- Communication and Transparency: Open communication channels and transparent reporting are essential for a successful outsourcing partnership.

Outsourcing RCM can be a strategic and effective way for healthcare providers of all sizes to optimize revenue cycle performance. By partnering with a qualified RCM outsourcing company, you can gain access to specialized expertise, reduce costs, and streamline processes to improve financial stability and focus on delivering exceptional patient care.

ROI Metrics for Outsourcing RCM

While the previous section explored the advantages of outsourcing RCM, measuring the return on investment (ROI) of this decision is crucial. Here are some key metrics to track that demonstrate the financial benefits of outsourcing RCM:

- Improved First-Pass Acceptance Rates: First-pass acceptance rate (FPAR) refers to the percentage of claims submitted that are accepted by insurance companies on the first attempt. Outsourcing to an experienced RCM company with expertise in accurate coding and claim submission can significantly improve FPAR. This translates to fewer denials and rework, leading to faster reimbursement.

- Reduction in Days in Accounts Receivable (AR) (SEO Keyword: Days in AR): As discussed earlier, Days in AR reflects the average time it takes to collect payments from patients and insurance companies. Efficient outsourcing can lead to faster claim submission, fewer denials, and improved follow-up procedures, resulting in a reduction in AR days. This translates to a faster cash flow cycle and improved financial health.

- Net Collections Increase (SEO Keyword: Net Collections Increase): Net collections represent the total amount of revenue collected after accounting for contractual adjustments, write-offs, and bad debt. Effective RCM outsourcing can lead to improved claim accuracy and faster payment processing, ultimately increasing the net collections rate. This translates to a direct increase in your practice’s revenue.

Additional Metrics to Consider:

Beyond these core financial metrics, several other factors contribute to the ROI of RCM outsourcing:

- Reduced Administrative Costs: Outsourcing can significantly reduce expenses associated with staffing, training, and technology infrastructure for in-house RCM activities.

- Improved Staff Productivity: Freeing your internal team from repetitive RCM tasks allows them to focus on higher-value activities related to patient care and practice operations.

- Enhanced Patient Satisfaction: Efficient billing processes and faster claim resolution can lead to improved patient satisfaction and a positive experience.

Measuring the ROI of Outsourcing:

To determine the ROI of RCM outsourcing, you can utilize the following formula:

ROI = [(Increase in Net Collections – Outsourcing Costs) / Outsourcing Costs] x 100%

This calculation considers the increase in revenue generated by improved RCM processes compared to the cost of outsourcing services. It’s important to track these metrics over time to gain a comprehensive understanding of the financial impact of outsourcing RCM on your practice.

Outsourcing RCM offers the potential for a significant return on investment. By focusing on improved first-pass acceptance rates, reduced days in AR, and increased net collections, you can demonstrate the financial benefits of outsourcing. Combined with other advantages such as improved efficiency and staff productivity, outsourcing RCM can be a strategic decision leading to a more optimized and profitable healthcare practice.

Practical Steps to Measure ROI for RCM

Having established the key metrics and potential ROI of outsourcing RCM, let’s delve into practical steps for effectively measuring your return on investment:

1. Regular Tracking and Analysis:

The key to measuring ROI lies in consistent tracking and analysis of relevant metrics. Here’s how to implement a tracking system:

- Define Metrics and Data Sources: Identify the specific metrics you’ll track, such as first-pass acceptance rate, days in AR, net collections, and potentially administrative costs. Determine the data sources for each metric (e.g., billing software, RCM reports, financial statements).

- Establish Baseline Data: Gather historical data for your chosen metrics before outsourcing RCM. This baseline provides a reference point for measuring improvement after outsourcing is implemented.

- Schedule Regular Reviews: Set a regular schedule for reviewing your RCM performance metrics. Quarterly reviews are a good starting point, allowing you to track progress and identify areas for improvement.

2. Data Collection and Reporting:

Having a robust data collection system is vital for accurate ROI measurement.

- Collaboration with RCM Partner: Work with your RCM outsourcing partner to ensure seamless data collection and reporting. Establish a mechanism for them to provide you with the necessary data points on a regular basis.

- Standardized Reporting Format: Develop a standardized reporting format that clearly presents key RCM metrics and allows for easy comparison over time. This facilitates trend analysis and helps identify areas where outsourcing contributes to positive financial impact.

3. Using Advanced Analytics:

Beyond basic tracking, consider incorporating advanced analytics tools to gain deeper insights into your RCM performance:

- Benchmarking: Compare your RCM metrics against industry benchmarks to understand how your performance stacks up against similar healthcare providers.

- Trend Analysis: Analyze trends in your RCM metrics over time. This can reveal the impact of outsourcing on areas like claim denials, collection timelines, and overall revenue cycle efficiency.

- Predictive Analytics: Leverage advanced analytics tools to predict potential issues and opportunities within your RCM processes. This proactive approach allows you to optimize resource allocation and maximize the benefits of outsourcing.

By implementing these practical steps for measuring ROI, you can gain valuable insights into the effectiveness of your RCM outsourcing decision. Regular tracking, data-driven analysis, and leveraging advanced analytics will equip you to demonstrate the financial benefits of outsourcing and ensure your RCM strategy remains optimized for long-term financial success.

Conclusion: Optimizing Your RCM for Financial Success with ProMantra

In conclusion, navigating the complexities of Revenue Cycle Management (RCM) requires a data-driven approach and a commitment to continuous optimization. This guide has equipped you with the knowledge to measure ROI from RCM, identify key performance indicators, and explore the potential benefits of AI and outsourcing.

At ProMantra, we understand the unique challenges healthcare providers face in optimizing their RCM. We offer a comprehensive suite of solutions designed to streamline your revenue cycle and maximize financial performance.

Here’s how ProMantra can empower your RCM success:

- Expert RCM Consulting: Our team of RCM specialists collaborates with you to identify areas for improvement and develop a customized strategy for optimization.

- Advanced RCM Technology: We leverage cutting-edge technology solutions, including AI-powered automation and advanced analytics tools, to enhance efficiency and accuracy.

- Outsourcing Solutions: ProMantra offers comprehensive RCM outsourcing services, connecting you with a team of experienced professionals dedicated to maximizing your revenue capture.

- Data-driven Insights: We provide comprehensive reporting and analytics to give you clear visibility into your RCM performance and empower informed decision-making.

By partnering with ProMantra, you gain access to a comprehensive suite of RCM solutions designed to transform your revenue cycle into a well-oiled engine for financial success. Contact ProMantra today to schedule a free consultation and learn how we can help you optimize your RCM and achieve your financial goals.

Remember, a well-optimized RCM system is not just about financial gains – it ultimately translates to better patient care by ensuring your practice has the resources it needs to thrive.