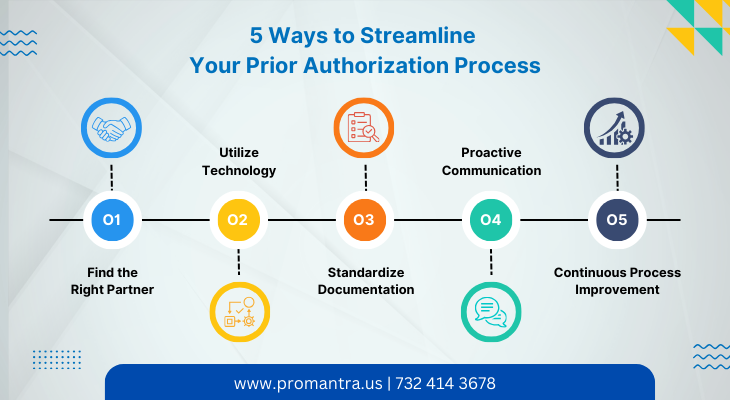

5 Ways to Streamline Your Prior Authorization Process

Prior authorization is essential to the healthcare system, ensuring patients receive the necessary medical treatments and procedures while minimizing insurance companies’ costs. However, the prior authorization process can often take time and effort for healthcare providers. To streamline this process and improve efficiency, here are five effective strategies to consider:

Prior Authorization Company – Finding the Right Partner

One of the most effective ways to streamline your prior authorization process is to partner with a reliable prior authorization company. The right partner can significantly affect the efficiency and effectiveness of your prior authorization services.

A reputable prior authorization company handles the complex paperwork and communication needed to obtain prior authorizations. They have the expertise and resources to navigate the intricate processes of various insurance companies. By outsourcing this task to a trusted partner, healthcare providers can get more productive.

When searching for a prior authorization company, it’s essential to consider their track record, reputation, and experience in the industry. Look for a company with a strong network of connections with insurance providers and a proven success rate in obtaining timely authorizations. A reliable partner should also comprehensively understand the requirements and guidelines for different procedures, treatments, and insurance plans.

Furthermore, the right prior authorization company should offer transparency and clear communication. They should provide regular updates on the status of authorizations and be readily available to address any concerns or inquiries. A good partner will work with healthcare providers to ensure a smooth and efficient prior authorization process.

Prior Authorization Services – Utilizing Technology

Utilizing technology is crucial for streamlining prior authorization services and improving efficiency. An electronic prior authorization system can revolutionize how healthcare providers handle the authorization process.

Electronic systems provide a seamless and automated workflow, reducing the need for manual effort that includes paperwork and phone calls. With an electronic prior authorization system, healthcare providers can submit and track authorization requests digitally, eliminating the delays and errors associated with paper-based processes. This not only saves time but also reduces administrative burdens.

Additionally, electronic systems allow for real-time communication between healthcare providers, insurance companies, and pharmacies. This enables faster and more accurate exchange of information, ensuring that all parties are on the same page throughout the prior

authorization process. Electronic systems also provide alerts and notifications for pending authorizations, enabling proactive follow-up and minimizing unnecessary delays.

Moreover, technology can help healthcare providers access and share patient data more efficiently. Integrated electronic health record (EHR) systems can streamline documentation by automatically populating relevant patient information into prior authorization forms. This eliminates the need for duplicate data entry and reduces the chances of errors.

It’s essential to choose a technology solution that is user-friendly and compatible with existing systems. Training and support should be provided to maximize the benefits of the technology. Regular updates and enhancements should also be available to keep up with changing regulations and requirements.

Top Prior Authorization Companies – Standardizing Documentation

Standardizing documentation is crucial to streamlining prior authorization services, and partnering with top prior authorization companies can significantly facilitate this process. These companies specialize in navigating the complex landscape of various insurance providers and have established relationships with multiple insurers.

One of the main challenges in the prior authorization process is the inconsistency in documentation requirements across different insurance companies. Each insurer may have its specific forms, guidelines, and documentation criteria. This can lead to confusion and delays for healthcare providers when preparing and submitting prior authorization requests.

By working with top prior authorization companies, healthcare providers can benefit from their expertise and knowledge of different insurers’ requirements. These companies deeply understand the documentation needed for different procedures, treatments, and insurance plans. They can help standardize the documentation process, ensuring all necessary information is included in the initial submission.

Top prior authorization companies also stay current with the latest industry changes and updates in documentation requirements. They can provide guidance and support in navigating the evolving landscape of prior authorization regulations. This ensures that healthcare providers know any new documentation requirements and can adapt their processes accordingly.

Standardizing documentation not only reduces the likelihood of delays due to missing or incomplete information, but it also improves communication and collaboration between healthcare providers and insurance companies. When documentation is consistent and meets the requirements of multiple insurers, the chances of receiving timely approvals increase significantly.

Prior Authorization Services – Proactive Communication

Proactive communication is vital for streamlining prior authorization services and ensuring a smoother and more efficient process. By establishing open and proactive lines of communication with insurance companies, healthcare providers can minimize delays and ensure timely approvals for their patients’ treatments.

One of the critical benefits of proactive communication is the ability to promptly address any issues or concerns arising in the prior authorization process. Healthcare providers can quickly identify and resolve potential roadblocks or misunderstandings by staying in regular contact with insurance companies. This proactive approach helps prevent unnecessary delays and ensures the necessary authorizations are obtained as quickly as possible.

Proactive communication also enables healthcare providers to stay informed about the status of prior authorization requests. By actively following up on pending authorizations, providers can effectively manage their patients’ treatment plans and make informed decisions based on the progress made in the prior authorization process. This level of communication helps maintain

transparency and accountability between healthcare providers and insurance companies.

Furthermore, proactive communication allows for better coordination and collaboration among all parties involved in the prior authorization process. By establishing strong working relationships with insurance representatives, healthcare providers can effectively advocate for

their patients and ensure all necessary information is promptly shared. This collaboration helps streamline the process and facilitates a smoother exchange of information, ultimately leading to faster approvals.

To implement proactive communication, healthcare providers should establish clear communication channels with insurance companies. This may include regular check-ins via phone, email, or dedicated online portals. Providers should also ensure that they have a designated point of contact within the insurance company to address concerns that may arise.

Insurance Authorization – Continuous Process Improvement

Streamlining the prior authorization process is an ongoing effort. It is important to regularly evaluate and improve the efficiency of your prior authorization services. Analyze data and feedback to identify bottlenecks or areas for improvement. Implementing process improvements, such as automating specific tasks or revising workflows, can lead to significant time and cost savings in the long run.

One key benefit of continuous process improvement in insurance authorization is identifying and eliminating bottlenecks and inefficiencies. Organizations can identify areas causing delays or hindering productivity by regularly reviewing and analyzing the authorization process. This allows them to implement targeted improvements and streamline the process, reducing the time and effort required to obtain authorizations.

Continuous process improvement lets organizations stay updated with changing insurance requirements and regulations. Insurance companies often revise their documentation criteria, forms, and guidelines. By actively monitoring these changes and updating their processes accordingly, organizations can ensure they consistently meet the latest insurance standards. This helps prevent rejections and delays due to non-compliance with insurance requirements.

Why choose Promantra for your Prior Authorization Services:

Promantra is a top prior authorization company that is an excellent choice for streamlining the prior authorization process. With our dedication to client satisfaction, Promantra offers services that can significantly enhance efficiency and effectiveness in obtaining prior authorizations.

Promantra’s expertise and relationships with insurance companies contribute to its success as a top prior authorization company. We deeply understand the industry and stay updated with the latest regulations and requirements. This knowledge allows us to easily navigate the prior authorization process and deliver optimal results for their clients.

Below are the unique benefits of Outsourcing Prior-Authorization Services to Promantra:

- Expertise in standardizing documentation for a smoother and more efficient prior authorization process.

- Proactive communication to address concerns and resolve issues promptly.

- Utilization of advanced technology for automated workflows and improved communication.

- Deep understanding of insurance requirements and regulations for optimal results.

- Strong relationships with insurance companies for faster exchange of information.

- Minimized delays and improved efficiency in obtaining prior authorizations.

- Reduction of administrative burdens through electronic prior authorization systems.

- Enhanced coordination and collaboration among all parties involved.

- Timely follow-ups and issue resolution for a seamless process.

- Industry expertise and up-to-date knowledge to navigate the complexities of prior authorizations.

With Promantra, you can streamline your prior authorization services and ensure a smoother and more efficient process. Contact us today.