According to a report by the American Medical Association (AMA), nearly 25% of medical claims are denied initially, with DME billing errors being a significant contributor.

Navigating the complexities of DME billing errors and adhering to Medicare DME billing guidelines is crucial to avoid DME claim denials and ensure a smooth DME reimbursement process.

Let’s explore common pitfalls and how to avoid them.

Understanding DME Billing & Reimbursement

If you’ve ever dealt with Durable Medical Equipment (DME) billing, you know it’s not exactly a walk in the park.

Between strict guidelines, complex documentation, and ever-changing payer policies, it’s easy to see why many providers struggle with DME billing errors and claim denials.

But don’t worry—we’re here to explain everything. Let’s start by understanding DME, how the billing process works, and what Medicare, Medicaid, and private insurers expect regarding reimbursement.

What Qualifies as Durable Medical Equipment (DME)?

First things first: what exactly counts as DME? Think of DME as the medical equipment your patients need to manage their health at home. But not just any equipment qualifies. To be considered DME, the item must meet three key criteria:

- Durability: It should be built to last and withstand repeated use.

- Medical Necessity: A healthcare provider must prescribe it to treat a specific illness, injury, or condition.

- Home Use: It’s primarily intended for use in the patient’s home, not in a hospital or clinic.

Examples include wheelchairs, walkers, hospital beds, oxygen tanks, and CPAP machines. Knowing what qualifies as DME is the foundation for avoiding DME claim denials and staying compliant with Medicare DME billing guidelines.

Key Components of the DME Billing Process

Now, let’s talk about the nuts and bolts of DME billing. It’s a multi-step process; each step is crucial to getting paid on time and in full. Here’s what it typically involves:

- Patient Eligibility Verification: You must confirm the patient’s insurance coverage before anything else. Are they enrolled in Medicare, Medicaid, or a private plan? What’s their deductible, and is the equipment covered under their policy? Skipping this step is a fast track to DME billing errors.

- Medical Necessity Documentation: This is where many claims go off the rails. Payers want proof that the equipment is medically necessary, so you’ll need a Detailed Written Order (DWO) or Certificate of Medical Necessity (CMN) from the prescribing physician.

- Accurate Coding: Using the correct HCPCS codes is non-negotiable. A single coding error can lead to a denied claim, so double-check those codes before submission.

- Claim Submission: Once everything’s in order, it’s time to submit the claim. Whether you’re billing Medicare, Medicaid, or a private insurer, ensure the claim is clean and complete.

- Follow-Up and Appeals: Denials happen, but they don’t have to be the end of the road. Stay on top of your claims, and if you get a denial, act quickly to appeal it.

Medicare, Medicaid, and Private Insurance Policies for DME Reimbursement

Here’s where things get a little tricky. Each payer has its own set of rules, and if you don’t play by them, you’re looking at DME claim denials. Let’s break it down:

- Medicare: Medicare is notoriously strict when it comes to DME billing. They require a Detailed Written Order (DWO) or Certificate of Medical Necessity (CMN) for most equipment, and they’ve got competitive bidding programs in certain areas that can affect reimbursement rates. If you’re billing Medicare, you’ve got to dot every “i” and cross every “t.”

- Medicaid: Medicaid policies vary by state, so what works in California might not fly in Texas. Ensure you’re up to speed on your state’s specific DME coverage rules and documentation requirements.

- Private Insurance: Private insurers are a mixed bag. Some are relatively easy to work with, while others have a list of requirements, like pre-authorization or specific claim forms. The key is to know your payer’s policies inside and out.

Understanding these policies is half the battle. The other half is implementing them correctly to avoid DME billing errors and keep your claims flowing.

Now that we’ve covered the basics let’s examine the most common DME billing errors and learn how to avoid them.

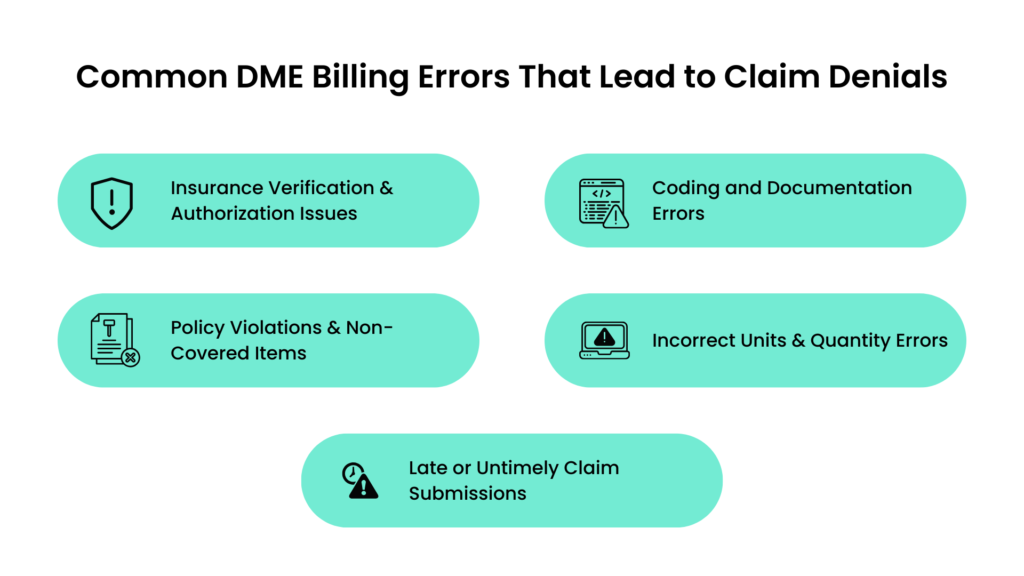

Common DME Billing Errors That Lead to Claim Denials

Even with the best intentions, errors in DME billing can occur, leading to DME claim denials and significant revenue loss for healthcare providers.

Below, we explore the most frequent DME billing errors and provide actionable solutions.

1. Insurance Verification & Authorization Issues

Insurance verification and authorization are critical steps in the DME billing process. Errors in this stage can result in immediate claim denials. Common issues include:

- Missing or Incorrect Insurance Details: Submitting claims with incomplete or inaccurate patient insurance information, such as policy numbers or coverage details, can lead to rejections.

- Failure to Obtain Prior Authorization: Many payers require prior authorization for specific DME items. Failing to secure this authorization before providing the equipment often results in denied claims.

- Policy Discrepancies Causing Coverage Denials: Misunderstanding the patient’s insurance policy, such as coverage limits or exclusions, can lead to claim rejections.

How to Avoid These Errors:

- Verify patient insurance details thoroughly before providing DME.

- Confirm prior authorization requirements for each item and obtain approval in advance.

- Stay updated on payer-specific policies to ensure compliance.

2. Coding and Documentation Errors

Accurate coding and documentation are the backbone of successful DME billing. Mistakes in this area are a leading cause of DME claim denials. Common errors include:

- Incorrect HCPCS Codes: Using the wrong Healthcare Common Procedure Coding System (HCPCS) codes for DME items can result in claim rejections.

- Insufficient Documentation to Justify Medical Necessity: Payers require detailed documentation, such as a Detailed Written Order (DWO) or Certificate of Medical Necessity (CMN), to prove the equipment is medically necessary. Incomplete or unclear documentation often leads to denials.

- Errors in Physician Orders and Patient Records: Discrepancies between physician orders and patient records can raise red flags for payers, resulting in claim rejections.

How to Avoid These Errors:

- Double-check HCPCS codes before submitting claims.

- Ensure all documentation is complete, accurate, and aligns with payer requirements.

- Train staff to review physician orders and patient records for consistency.

3. Policy Violations & Non-Covered Items

Billing for items or services not covered under the patient’s insurance policy is a standard DME billing error. This includes:

- Billing for Non-Covered DME Services: Providing equipment not covered by the patient’s insurance can result in claim denials.

- Common Payer-Specific Restrictions: Each payer has unique restrictions, such as coverage limits or specific documentation requirements. Failing to adhere to these can result in rejections.

- Not Aligning Claims with Medicare and Medicaid DME Guidelines: Medicare and Medicaid have strict guidelines for DME billing. Non-compliance with these rules often leads to denials.

How to Avoid These Errors:

- Verify coverage for each DME item before providing it to the patient.

- Familiarize yourself with payer-specific restrictions and guidelines.

- Regularly review updates to Medicare DME billing guidelines and Medicaid policies.

4. Incorrect Units & Quantity Errors

Billing errors related to the quantity of DME items can also lead to claim denials. Common issues include:

- Overbilling or Underbilling for DME Supplies: Submitting claims for incorrect quantities, whether too high or too low, can result in rejections.

- Mismatched Quantity Billed vs. Quantity Authorized: Payers often deny claims if the quantity billed does not match the amount authorized in the prescription or prior authorization.

- Failing to Follow Payer-Specific Quantity Limits: Many payers impose quantity limits on DME items. Exceeding these limits can lead to claim denials.

How to Avoid These Errors:

- Carefully review the quantity of DME items provided and billed.

- Ensure the amount billed matches the amount authorized by the payer.

- Adhere to payer-specific quantity limits for DME supplies.

5. Late or Untimely Claim Submissions

- Timeliness is critical in the DME billing process: Late submissions can result in automatic claim denials and revenue loss. Common issues include:

- Missing Deadlines for DME Claim Submissions: Each payer has specific submission deadlines, often leading to denials.

- How Untimely Filing Leads to Revenue Loss: Delayed submissions can disrupt cash flow and create backlogs in the revenue cycle.

- Best Practices for Tracking and Managing Submission Timelines: To avoid errors, it is essential to implement systems to track and manage claim submission deadlines.

How to Avoid These Errors:

- Monitor payer-specific submission deadlines and adhere to them strictly.

- Use practice management software to track claim submission timelines.

- Establish a routine for timely claim submissions and follow-ups.

DME Claim Denials & Reimbursement Challenges

DME claim denials persist for healthcare providers, often leading to delayed payments and increased administrative workloads.

To maintain a healthy revenue cycle, it’s essential to understand the common reasons for denials, implement strategies to prevent them, and know how to file successful appeals.

Let’s explore these aspects in detail.

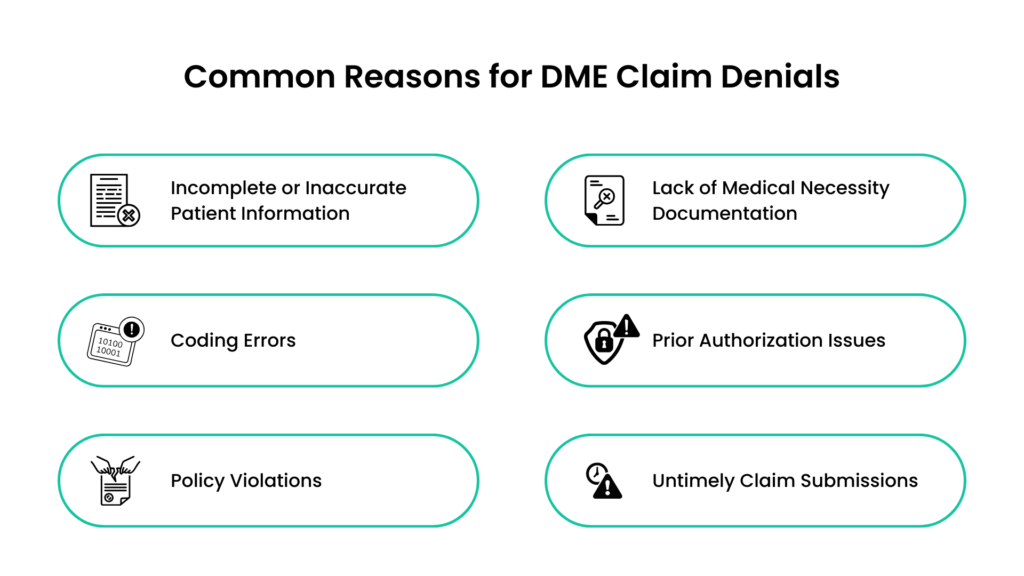

Common Reasons for DME Claim Denials

Claim denials can occur for various reasons, many of which are preventable with proper attention to detail. The most frequent causes include:

- Incomplete or Inaccurate Patient Information: Missing or incorrect details, such as the patient’s name, date of birth, or insurance information, can lead to immediate rejections.

- Lack of Medical Necessity Documentation: Payers require thorough documentation, such as a Detailed Written Order (DWO) or Certificate of Medical Necessity (CMN), to justify the need for DME. Insufficient documentation is a leading cause of denials.

- Coding Errors: Incorrect or mismatched HCPCS codes for DME items can result in claim rejections.

- Prior Authorization Issues: Failing to obtain prior authorization for DME items that require it often leads to denials.

- Policy Violations: Billing for non-covered items or exceeding quantity limits specified by the payer can result in claim rejections.

- Untimely Claim Submissions: Missing payer-specific submission deadlines is a common reason for automatic denials.

Understanding these reasons is the first step toward reducing DME claim denials and improving reimbursement rates.

Strategies for Denial Prevention and Faster Reimbursements

Preventing claim denials requires a proactive approach and attention to detail. Here are some effective strategies to minimize errors and expedite the DME reimbursement process:

- Verify Patient Information and Insurance Coverage: Before providing DME, double-check patient details and insurance eligibility. Ensure the patient’s policy covers the prescribed equipment.

- Ensure Complete and Accurate Documentation: Obtain and review all necessary documentation, such as DWOs or CMNs, to justify medical necessity and ensure it aligns with payer requirements.

- Use Correct HCPCS Codes: Train staff to use accurate and up-to-date HCPCS codes for DME items. Regularly audit coding practices to identify and correct errors.

- Obtain Prior Authorization: Confirm whether prior authorization is required for the DME item and secure approval before providing the equipment.

- Stay Updated on Payer Policies: To ensure compliance, regularly review updates to Medicare DME billing guidelines, Medicaid policies, and private insurer requirements.

- Submit Claims Timely: Monitor payer-specific submission deadlines and establish a system to track and manage claim submissions.

How to File Successful Appeals for Rejected DME Claims

Despite best efforts, claim denials can still occur. When they do, filing a successful appeal is crucial to recovering lost revenue. Here’s how to approach the appeals process effectively:

- Review the Denial Reason: Carefully analyze the reason for the denial provided by the payer. Common reasons include missing documentation, coding errors, or policy violations.

- Gather Supporting Documentation: Collect all relevant documentation, such as the original claim, medical records, DWOs, CMNs, and any correspondence with the payer.

- Correct Errors and Resubmit: If the denial was due to an error, such as incorrect coding or missing information, correct the issue and resubmit the claim promptly.

- Write a Clear and Concise Appeal Letter: Draft a professional appeal letter that outlines the reason for the appeal, provides supporting evidence, and references relevant payer policies or guidelines.

- Follow Payer-Specific Appeal Procedures: Each payer has its appeal process and deadlines. Ensure you follow the correct procedures and submit the appeal within the required timeframe.

- Track the Appeal Status: Monitor the appeal’s status and follow up with the payer if necessary. Persistence is key to resolving denied claims.

Patient Communication & Billing Transparency

Clear communication and billing transparency are essential for building patient trust and minimizing disputes.

Patients who understand their DME coverage and costs are more likely to comply with treatment plans and payment obligations.

Additionally, proper documentation in patient records ensures accuracy and accountability. Let’s explore how to achieve these goals effectively.

Ensuring Patients Understand DME Coverage and Costs

Many patients are unaware of what their insurance covers or how much they must pay out-of-pocket for DME. This lack of understanding can lead to confusion, frustration, and even billing disputes. To address this:

- Explain Coverage Details: Explain what the patient’s insurance plan covers, including any limitations or exclusions. For example, if a wheelchair is covered but certain accessories are not, ensure the patient knows this upfront.

- Provide Cost Estimates: Offer a detailed breakdown of costs, including the patient’s expected co-pays, deductibles, or co-insurance. Transparency helps patients plan financially.

- Discuss Prior Authorization Requirements: Inform patients if prior authorization is needed and explain how it may affect the timeline for receiving their equipment.

Preventing Billing Disputes Due to Unclear Financial Responsibilities

Billing disputes often arise when patients are surprised by unexpected charges. To prevent this:

- Provide Written Financial Agreements: Before providing DME, patients should sign a written agreement outlining their financial responsibilities, including payment plans or options for financial assistance.

- Communicate Changes Promptly: If the patient’s coverage or costs change, notify them immediately and explain the impact.

- Offer Payment Options: Provide flexible payment options like installment plans to help patients manage out-of-pocket expenses.

Proactive communication and transparency can significantly reduce billing disputes and improve patient satisfaction.

Importance of Proper Documentation in Patient Records

Accurate and thorough patient record documentation is critical for billing and patient care. Proper documentation ensures:

- Compliance with Payer Requirements: Detailed records, including physician orders, proof of medical necessity, and delivery confirmations, are essential for avoiding DME claim denials.

- Clear Communication Among Providers: Well-documented records help other healthcare providers understand the patient’s treatment plan and equipment needs.

- Legal and Financial Protection: Proper documentation serves as evidence to support claims and decisions in the event of a dispute or audit.

To maintain high-quality records:

- Ensure all documentation is complete, accurate, and up-to-date.

- Train staff on proper documentation and compliance with Medicare DME billing guidelines.

- Electronic health records (EHR) systems are used to streamline documentation and reduce errors.

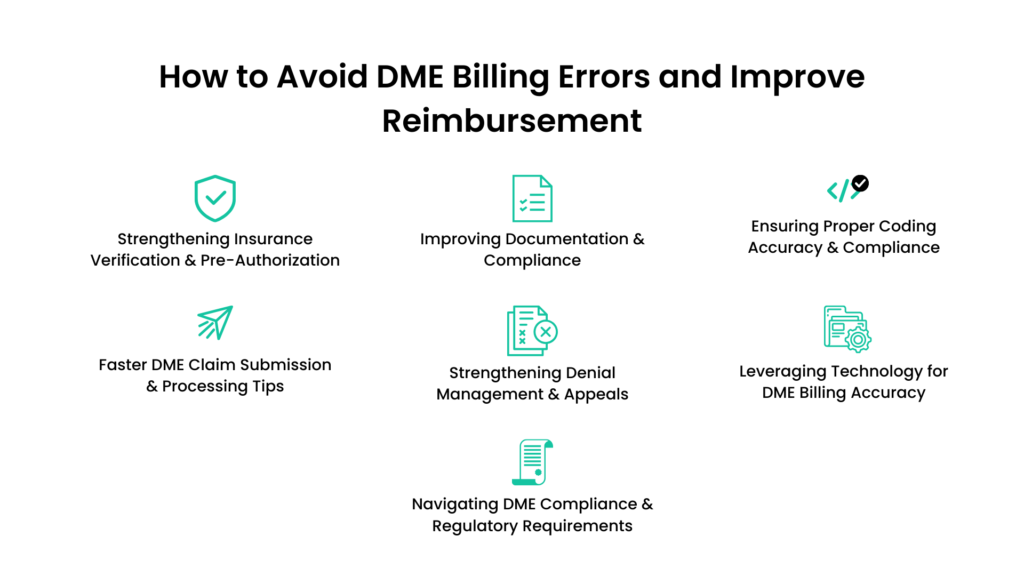

How to Avoid DME Billing Errors and Improve Reimbursement

Avoiding DME billing errors and improving reimbursement requires a proactive approach, attention to detail, and the right tools.

By strengthening key areas like insurance verification, documentation, coding accuracy, and denial management, healthcare providers can streamline the DME reimbursement process and minimize claim denials. Here are some great tips to achieving these goals.

1. Strengthening Insurance Verification & Pre-Authorization

Insurance verification and pre-authorization are critical steps in preventing DME claim denials. Common issues include missing or incorrect patient information and failure to obtain prior authorization. To address these challenges:

- Use Automated Eligibility Checks: Implement tools that automatically verify patient insurance eligibility and coverage details. This reduces manual errors and ensures accuracy.

- Ensure Proper Pre-Authorization: Confirm whether prior authorization is required for each DME item and obtain approval before providing the equipment. Keep a checklist of items that commonly require authorization.

Providers can reduce claim rejections and improve reimbursement rates by strengthening these processes.

2. Improving Documentation & Compliance

Accurate and thorough documentation is the backbone of successful DME billing. Incomplete or inconsistent records are a leading cause of DME billing errors. To improve documentation:

- Maintain Thorough Patient Records: Ensure all patient records, including physician orders, proof of medical necessity, and delivery confirmations, are complete and up-to-date.

- Align Physician Orders with Billed Items: Verify that the DME items billed match the physician’s orders and the patient’s medical records. Discrepancies can lead to denials.

Proper documentation supports claims and ensures compliance with Medicare DME billing guidelines and other payer requirements.

3. Ensuring Proper Coding Accuracy & Compliance

Coding errors are a major contributor to DME claim denials. Using incorrect or outdated HCPCS codes can result in rejected claims. To ensure coding accuracy:

- Conduct Regular Coding Audits: Review DME claims periodically to identify and correct coding errors. Audits help maintain compliance and reduce denials.

- Train Staff on Updated Guidelines: To ensure everyone is updated, billing staff should receive ongoing training on the latest HCPCS codes and DME billing guidelines.

Accurate coding is essential for timely and accurate reimbursement.

4. Faster DME Claim Submission & Processing Tips

Delayed claim submissions can lead to denials and disrupt cash flow. To speed up the DME reimbursement process:

- Submit Claims Electronically: Electronic claim submissions are processed faster than paper claims, reducing the risk of errors.

- Automate Billing Workflows: Use billing software to automate repetitive tasks like claim generation and submission. Automation minimizes manual errors and speeds up processing.

Faster claim submissions improve revenue cycle efficiency and reduce the risk of untimely filing denials.

5. Strengthening Denial Management & Appeals

Even with the best practices, claim denials can still occur. A robust denial management system is essential for recovering lost revenue. To strengthen this process:

- Implement a Denial Tracking System: Use software to track denied claims, identify patterns, and address recurring issues.

- Follow Best Practices for Appeals: When filing appeals, provide clear and concise documentation and reference payer policies, and adhere to deadlines. Persistence is key to resolving denials.

Effective denial management ensures that rejected claims are resolved promptly and revenue is recovered.

6. Leveraging Technology for DME Billing Accuracy

Technology plays a crucial role in reducing DME billing errors and improving efficiency. Key tools include:

- DME Billing Software: Specialized software can automate billing processes, verify insurance eligibility, and ensure compliance with payer guidelines.

- Integrated EHR Systems: Integrating electronic health records (EHR) with billing platforms streamlines documentation and reduces errors.

By leveraging technology, providers can enhance accuracy and efficiency in the DME reimbursement process.

7. Navigating DME Compliance & Regulatory Requirements

Compliance with state and federal regulations is essential to avoid penalties and ensure smooth operations. To stay compliant:

- Stay Updated on Medicare and Medicaid Policies: Regularly review updates to Medicare DME billing guidelines and Medicaid requirements.

- Conduct Regular Compliance Audits: Perform internal audits to identify and address compliance gaps.

- Adhere to State and Federal Regulations: Ensure all billing practices align with applicable laws and payer policies.

Compliance reduces the risk of audits and builds trust with payers and patients. A proactive approach, combined with the right tools and training, ensures a smoother revenue cycle and improved financial outcomes.

The Future of DME Billing: Trends and Innovations

The landscape of DME billing is rapidly evolving, driven by technological advancements and regulatory changes.

To stay ahead, healthcare providers must embrace emerging trends and innovations that can streamline the DME reimbursement process, reduce DME billing errors, and improve overall efficiency.

Let’s explore the key trends shaping the future of DME billing.

1. AI and Automation in DME Claim Processing

Artificial Intelligence (AI) and automation transform how DME claims are processed. These technologies offer several benefits:

- Automated Eligibility Verification: AI-powered tools can instantly verify patient insurance eligibility, reducing manual errors and saving time.

- Intelligent Claim Scrubbing: Automation can identify and correct errors in claims before submission, such as missing information or incorrect codes, minimizing the risk of DME claim denials.

- Streamlined Workflows: Automated systems can handle repetitive tasks like claim generation, submission, and follow-ups, allowing staff to focus on more complex issues.

2. Predictive Analytics for DME Billing Error Prevention

Predictive analytics is becoming a game-changer in preventing DME billing errors and improving reimbursement rates. This technology uses historical data to identify patterns and predict potential issues. Key applications include:

- Identifying High-Risk Claims: Predictive analytics can flag claims that are likely to be denied, allowing providers to address issues before submission.

- Optimizing Revenue Cycle Management: By analyzing trends in claim denials and reimbursement delays, providers can implement targeted improvements to their billing processes.

- Enhancing Decision-Making: Data-driven insights help providers make informed coding, documentation, and compliance decisions.

Predictive analytics empowers providers to address challenges and optimize the DME reimbursement process proactively.

3. Regulatory Changes Affecting DME Reimbursement Policies

Regulatory changes continue to shape the DME billing landscape, requiring providers to stay informed and adaptable. Key areas to watch include:

- Updates to Medicare DME Billing Guidelines: Medicare frequently updates its policies, such as coverage criteria and reimbursement rates. Providers must stay current to ensure compliance and avoid DME claim denials.

- Expansion of Telehealth Services: The growing use of telehealth for DME prescriptions and consultations may lead to new billing requirements and documentation standards.

- Increased Focus on Fraud Prevention: Regulatory bodies are intensifying efforts to combat fraud and abuse in DME billing. Providers must implement robust compliance programs to avoid penalties.

Staying ahead of regulatory changes is essential for maintaining compliance and ensuring smooth reimbursement.

Summing Up

DME billing is a complex and ever-evolving process. Still, with the right strategies and tools, healthcare providers can minimize DME billing errors, reduce DME claim denials, and optimize the DME reimbursement process.

There are numerous ways to improve efficiency and accuracy, from strengthening insurance verification and documentation to leveraging cutting-edge technologies like AI and predictive analytics.

Staying informed about regulatory changes and adopting best practices ensures compliance and fosters financial stability.

However, navigating these challenges alone can be overwhelming. Partnering with experts specializing in DME billing can make all the difference in achieving seamless operations and maximizing revenue.

Partner with Promantra for Streamlined DME Billing Solutions

Are you ready to transform your DME billing process and eliminate costly errors? At Promantra, we specialize in providing tailored revenue cycle management solutions designed to simplify billing workflows, ensure compliance, and boost reimbursement rates.

Our team of experts leverages advanced technology and industry expertise to help you navigate the complexities of Medicare DME billing guidelines, reduce DME claim denials, and improve your overall financial performance.

Don’t let billing challenges hold you back. Visit Promantra today to learn how we can help you achieve a more efficient and profitable DME billing process.

Let’s work together to streamline your operations and focus on what matters most—providing exceptional patient care.