Why do even the busiest Emergency Departments (EDs) face financial bottlenecks? Higher patient inflow doesn’t always lead to more substantial cash flow. The issue lies in Revenue Cycle Management (RCM), the behind-the-scenes processes affecting your financial outcomes.

From 2021 to 2023, the final denial rate for inpatient claims rose by over 50%, and billing errors cost the U.S. healthcare system $125 billion annually. With the U.S. RCM market expected to hit $272.78 billion by 2030, hospitals are increasingly focusing on efficient RCM strategies. In emergency care, where patient cases are unpredictable, insurance authorizations are urgent, and coding is complex, an optimized revenue cycle is critical for your financial health.

In this guide, you’ll explore best practices for improving Emergency Department RCM, including patient registration, denial management, coding accuracy, and advanced analytics. But first, let’s define Emergency Department Revenue Cycle Management (RCM).

Understanding Emergency Department Revenue Cycle Management

Emergency Department Revenue Cycle Management (RCM) is the behind-the-scenes engine that keeps the financial flow of your emergency department running smoothly. It covers everything from the moment a patient steps into your department to the final payment or reimbursement. RCM ensures that your ED is reimbursed for the care provided by handling billing, coding, insurance verification, and addressing denials, turning chaos into clarity in the financial world.

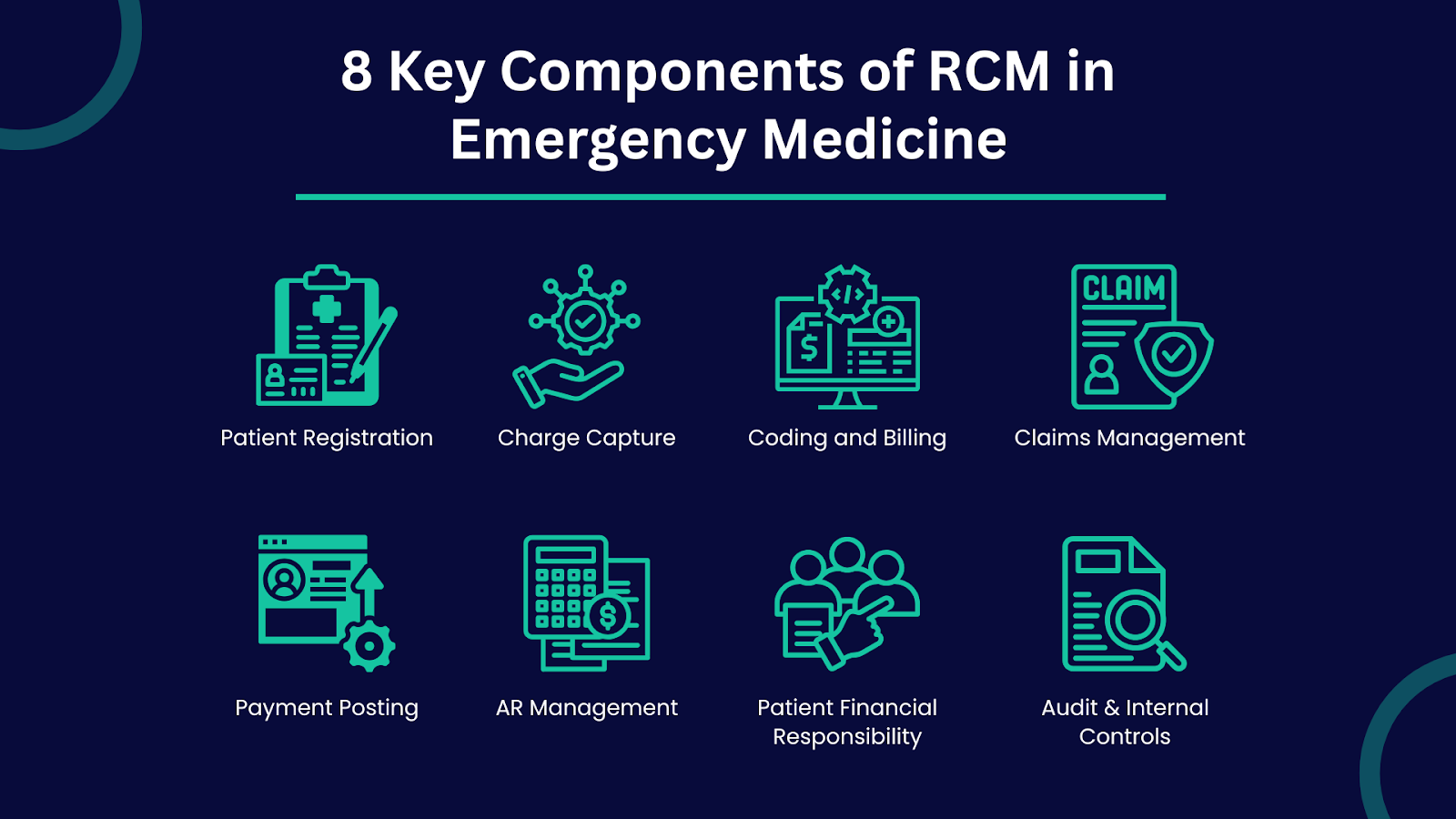

8 Key Components of RCM in Emergency Medicine

Every Emergency Department must have a robust, seamless revenue cycle process to maintain financial stability and operational efficiency.

Here’s a breakdown of its essential components:

1. Patient Registration

The revenue cycle begins the moment a patient walks through the door. Accurate patient demographics and insurance information capture are critical here. Errors or omissions at this stage often lead to claim denials or delayed payments.

Pro Tip: Use real-time insurance eligibility verification tools to minimize errors and accelerate billing.

2. Charge Capture

Charge capture involves documenting all services, procedures, and treatments provided during an emergency department (ED) visit. Incomplete or missed charge capture leads to revenue leakage, one of the most overlooked financial drains in emergency care.

3. Coding and Billing

Medical coders translate patient care into standardized codes used for billing insurers. Emergency medicine coding is especially complex due to the range of services and severity levels involved. Errors in coding can lead to compliance risks and underpayment issues, making it essential to have trained, certified coders familiar with emergency care-specific codes like CPT and ICD-10.

Also Read: How Does Medical Billing and Coding Increase Cash Flow

4. Claims Management

Once coded, claims are submitted to payers, and the real work begins here: monitoring claim status, addressing rejections, and managing denials.

5. Payment Posting

After payments are received, accurate posting to patient accounts ensures that records are up to date and reconciled. Errors in payment posting can distort financial reporting and impact cash flow forecasts.

6. Accounts Receivable (AR) Management

Managing unpaid claims and following up on overdue payments is crucial for maintaining a steady cash flow. A healthy AR aging report directly reflects the efficiency of your RCM process.

7. Patient Financial Responsibility

After payment posting, it is essential to communicate with the patient regarding their responsibility for any remaining balances. Transparency about out-of-pocket costs and payment plans helps ensure that patients understand their obligations, reducing the likelihood of bad debt.

8. Audit and Internal Controls

Regular audits and strong internal controls help detect fraud, prevent billing errors, and ensure all processes comply with industry standards and regulations. This is especially critical in emergency medicine, where complex billing and coding are prevalent.

Also Read: What is Medical Coding? A Comprehensive Guide

Now that we’ve learned about the essential components, let’s dive deeper into actionable best practices for enhancing Revenue Cycle Management in the Emergency Department.

8 Best Practices for Enhancing Revenue Cycle Management in the Emergency Department

Optimizing RCM in emergency medicine isn’t just about handling claims; it’s about creating a system that minimizes errors, accelerates cash flow, and enhances the patient experience for your department.

Here are the essential best practices you should adopt:

1. Accurate Patient Information Collection

The foundation of effective RCM lies in gathering precise demographic and insurance details at the point of entry. Incorrect or incomplete patient information is one of the leading causes of claim denials and payment delays.

Best Practices:

- Implement real-time eligibility verification systems.

- Train your front-desk teams to double-check insurance data.

- Streamline the pre-registration process with digital forms and automated verification tools to reduce human errors.

2. Charge Capture and Documentation

Missed charges are a significant factor in lost revenue for hospitals, particularly in high-volume emergency departments.

Best Practices:

- Use mobile charge capture applications for physicians.

- Perform routine charge audits.

- Implement Clinical Documentation Improvement (CDI) programs to ensure your clinical notes are detailed and compliant.

3. Timely and Accurate Coding

Emergency care involves complex cases with varying procedures, making coding accuracy non-negotiable.

Best Practices:

- Regularly update your coding teams on changes to ICD-10, CPT, and HCPCS codes.

- Conduct periodic coding audits to catch discrepancies.

- Provide targeted training on emergency department coding requirements.

4. Claims Submission Best Practices

Clean, error-free claims mean fewer denials and quicker payments.

Best Practices:

- Use automated claims scrubbing tools to catch issues before submission.

- Set up electronic claim submission systems.

- Monitor claim status daily to act on rejections immediately.

5. Payment Posting and Reconciliation

Incorrect payment posting can distort financial records and delay follow-ups on unpaid amounts.

Best Practices:

- Post payments promptly and reconcile daily.

- Use real-time data reporting to identify payment variances.

- Integrate payment posting with AR management for seamless follow-ups.

6. Denial Management and Appeals

Denials are inevitable, but they should never be ignored.

Best Practices:

- Track denial trends and root causes.

- Act on denials within 24-48 hours.

- Maintain an organised, documented appeals process with clear payer communication.

7. Effective Patient Communication

Many payment issues stem from poor financial communication with patients.

Best Practices:

- Educate patients about coverage, deductibles, and out-of-pocket costs upfront.

- Provide transparent, easy-to-read bills.

- Offer multiple payment options and financial counseling.

8. Automating Patient Financial Responsibility Collection

Collecting patient payments upfront can reduce bad debt and improve cash flow.

Best Practices:

- Implement point-of-service collections for co-pays and deductibles.

- Use patient portals to allow easy, secure online payment options.

- Offer payment plan options for patients with larger balances and ensure payment collections are part of your pre-visit financial discussions.

For emergency departments looking to streamline these processes, optimize cash flow, and minimize revenue leakage, end-to-end RCM partners like Promantra offer specialized solutions tailored for emergency medicine. From real-time insurance verification and advanced charge capture systems to certified emergency coders and dedicated denial management teams, Promantra’s services help EDS strengthen its revenue cycle while improving patient satisfaction.

Adopting these RCM best practices strengthens your cash flow, improves efficiency, and reduces denials in emergency departments.

Also Read: Denial Management in Medical Billing: Essential Strategies for Success.

Yet, despite these efforts, many practices still face persistent financial and operational challenges. Let’s explore the key issues that can disrupt even well-managed revenue cycles.

Challenges Faced by Emergency Medicine Practices Without RCM Support

Without expert financial oversight, your emergency department often finds itself navigating these operational pitfalls:

1. Keeping Up with Changing Regulations

Healthcare billing and coding regulations are constantly evolving, with frequent updates to rules, reimbursement models, and compliance standards. Keeping track of these changes can be overwhelming for your ED without a solid RCM strategy.

Falling behind on regulatory updates can lead to serious compliance issues, denied claims, and even financial penalties. This puts additional stress on your already overburdened administrative teams, potentially impacting your department’s revenue and operational efficiency.

2. Operational Costs and Errors

Internal billing teams, especially in smaller or less-equipped EDs, are often overwhelmed by the volume of claims, coding, and documentation required. The high-pressure environment can lead to delays, errors, and burnout.

These operational inefficiencies increase administrative costs and reduce your team’s overall effectiveness. As a result, errors multiply, leading to lost revenue, costly corrections, and a growing backlog of unresolved claims.

3. High Claim Denial Rates

Claim denials are one of the most common challenges faced by emergency medicine practices. Errors in documentation, incorrect coding, and missed pre-authorisations are frequent causes of claim rejections.

Without the expertise of an RCM partner to ensure thorough verification and accurate submission, denial rates can quickly escalate, leading to delayed reimbursements and increased administrative workloads. A high volume of denied claims creates a vicious cycle of rework, which reduces your overall cash flow and wastes valuable resources.

The solution to these challenges lies in implementing a dedicated RCM system like Promantra, which can significantly reduce claim denials. By automating claims verification, enabling real-time tracking, and ensuring accurate coding and documentation, Promantra minimizes errors and accelerates the reimbursement process.

For instance, a hospital struggling with high aging days and delayed reimbursements partnered with Promantra to improve its revenue cycle management. Through a comprehensive audit, Promantra identified inefficiencies in billing, claims processing, and contract management, and implemented:

- Optimised RCM Workflows: Streamlined billing and claims processes.

- Enhanced Revenue Management: Improved insurance contracts and staff training.

Results:

- Reduced aging days from 165 to 42.

- Recovered an additional 9% in revenue ($340K) within 90 days.

- Stabilized cash flow and cut operational costs, reinvesting in patient care.

This is where a strategic RCM partner can become more than a service provider; they become an operational ally. Now, let’s explore the key benefits of adopting a dedicated RCM solution.

Benefits of Partnering with a Dedicated RCM Solution

Adopting a specialised RCM partner isn’t just about outsourcing administrative tasks; it’s about transforming your financial operations into a seamless, efficient, and revenue-positive engine.

Here’s how a strategic RCM partner’s measurable value for emergency medicine practices:

- Reduced Administrative Burden: By handling complex billing, coding, and claim follow-ups, an RCM partner allows your clinical teams to focus on delivering quality patient care.

- Faster Reimbursements & Improved Cash Flow: With automated claim tracking, real-time analytics, and proactive denial management, your practice will experience faster payment cycles and stronger financial stability.

- Enhanced Accuracy & Compliance: Certified coders and billing experts ensure your claims meet the latest regulatory standards, reducing errors and safeguarding against penalties.

- Data-Driven Decision Making: Access to advanced analytics dashboards offers you actionable insights on claim trends, AR aging, and denial patterns, helping you make informed, strategic decisions.

- Operational Efficiency: Optimised workflows, seamless system integrations, and transparent reporting reduce your operational costs while increasing overall efficiency.

However, these benefits are only possible with the right RCM partner. Let’s quickly explore what to look for when choosing one for your emergency department.

Choosing the Right RCM Partner for Emergency Medicine

The key to successful outsourcing lies in selecting a partner who understands the unique demands of emergency medicine. Not all RCM providers are created equal.

Here’s what you should look for:

1. Industry Experience and Expertise

Choose a provider with a proven track record in emergency medicine billing. The right partner will have experience working with EDs to optimize revenue cycles, improve cash flow, and reduce AR days through tailored strategies.

2. Familiarity with Emergency Medicine Billing Codes

Your partner should have certified, experienced coders who specialize in CPT, ICD-10, and ED-specific billing regulations. Having a team of skilled coders ensures coding accuracy, reduces denials, and maximizes reimbursement.

3. Technology and System Integration

Modern RCM is driven by technology. It’s essential to find a partner whose systems integrate seamlessly with your hospital management software and EHR platforms. This ensures minimal disruption to existing workflows while enhancing operational efficiency.

4. Client References and Case Studies

Don’t hesitate to ask for success stories. Understanding how a provider has handled similar ED cases offers valuable insight into their ability to meet your unique needs.

5. Transparency and Reporting

Your RCM partner should empower you with real-time dashboards and reporting tools, giving you full control over financial operations, claim status, and denial trends. A transparent reporting system helps identify areas for improvement and enables data-driven decision-making.

You’ll find all these features in Promantra. With a proven track record in emergency medicine billing, Promantra helps your emergency departments (EDs) streamline revenue cycles and reduce Accounts Receivable (AR) days. Their certified coders, specialising in CPT, ICD-10, and ED-specific regulations, ensure accurate coding, minimise denials, and maximize reimbursements.

Promantra’s seamless integration with existing hospital management systems and EHR platforms ensures minimal disruption. Real-time dashboards provide complete visibility into financial operations, claim statuses, and denial trends.

By partnering with Promantra, emergency departments gain a trusted RCM ally that enhances financial performance, lowers operational costs, and allows clinical teams to focus more on patient care while optimising revenue.

Final Thoughts

As emergency medicine evolves, financial operations must keep up with the pace. Revenue cycle management is now the backbone of every emergency department, ensuring resources are available to provide lifesaving care.

If you’re looking for a reliable and experienced partner, Promantra offers tailored RCM solutions specifically designed for emergency medicine practices. These solutions integrate real-time eligibility checks, charge capture, denial management, and transparent reporting to help your ED thrive in a demanding healthcare economy.

Contact Promantra today to learn how our customized solutions can streamline your RCM processes and improve your emergency department’s efficiency.