In the intricate realm of healthcare, effective Revenue Cycle Management (RCM) is paramount for sustaining financial health and operational efficiency. A significant challenge within RCM is managing Accounts Receivable (AR) denials. These AR denial scenarios can disrupt cash flow, affect profitability, and strain administrative resources. This comprehensive blog delves deeper into common AR denial scenarios, their causes, and effective strategies for managing and mitigating these issues. By enhancing AR resolution processes, healthcare organizations can significantly improve their revenue cycle management and operational effectiveness

Understanding AR Denial Scenarios

AR denial scenarios in medical billing arise when a claim submitted to a payer is either denied or rejected, leading to delayed or lost revenue. These denials can stem from various issues, including incorrect coding, incomplete patient information, or lack of coverage. Understanding these scenarios is crucial for healthcare providers to develop effective denial management strategies and ensure a smoother revenue cycle. Effective AR management not only ensures prompt payments but also maintains the financial stability of healthcare organizations.

Common Reasons for Claim Denials

Claims can be denied for numerous reasons, including:

Coding Errors: Incorrect or outdated diagnosis or procedure codes can result in claim rejections. For example, using an outdated ICD code for a new diagnosis may lead to a denial due to non-compliance with the latest coding standards.

Patient Data Errors: Errors in patient information, such as incorrect dates of birth, misspelled names, or incorrect insurance details, can cause denials. Accurate patient data is critical for claim approval.

Lack of Coverage: Claims may be denied if a patient’s insurance policy does not cover the specific service or treatment provided. This can also occur if prior authorization is required but not obtained, or if services provided are deemed non-essential. Addressing these issues promptly and accurately is essential to minimize disruptions in the revenue cycle and ensure timely payments.

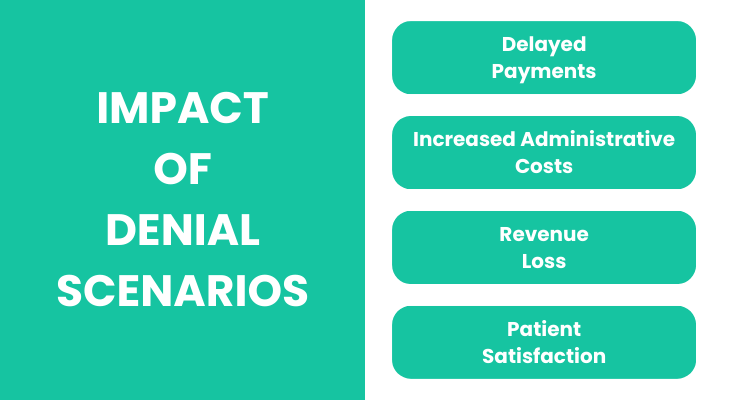

Impact of AR Denial Scenarios on Healthcare Organizations

The impact of AR denial scenarios can be profound:

Delayed Payments: Denials lead to delays in receiving payment, which can strain cash flow and hinder financial stability. For example, a delayed payment can affect a healthcare provider’s ability to pay staff and cover operational expenses.

Increased Administrative Costs: Resolving denials requires additional administrative work, increasing operational costs. This includes time spent on claim reprocessing, follow-ups, and administrative tasks.

Revenue Loss: Persistent denials may result in revenue loss if claims are not resolved or resubmitted in a timely manner. Over time, this can accumulate, impacting the organization’s financial health.

Patient Satisfaction: Denial issues can affect patient satisfaction, particularly if patients experience billing problems or unexpected charges. Clear communication and resolution of billing issues are essential for maintaining a positive patient experience. Efficiently managing AR denial scenarios is crucial for maintaining financial health, ensuring operational efficiency, and enhancing patient satisfaction.

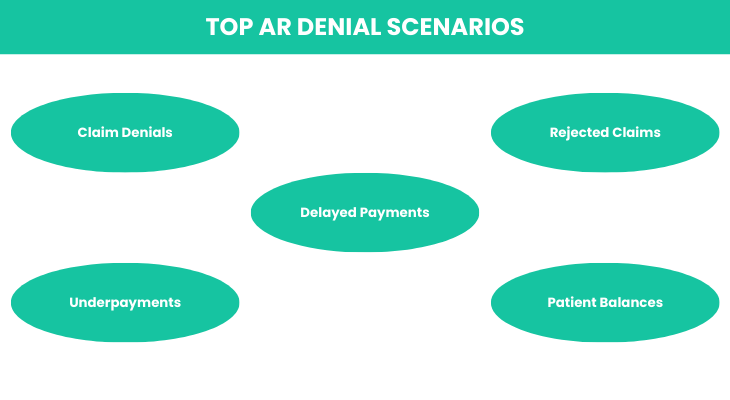

Top AR Denial Scenarios in Medical Billing

Claim Denials

Claim denials are a prevalent AR scenario in medical billing. They occur when an insurance company refuses to pay for a submitted claim due to various issues:

Incorrect Patient Data: Errors in patient details, such as incorrect insurance information or demographic data, can lead to denials. Ensuring accurate and up-to-date patient information is essential.

Coding Errors: Incorrect or outdated codes for procedures or diagnoses can result in rejection. For instance, using obsolete procedure codes may lead to a denial due to non-compliance with current coding practices.

Missing Information: Claims lacking necessary details, such as authorization numbers or supporting documentation, are often denied. Complete and accurate documentation is crucial for claim approval.

Recent statistics highlight a rising trend in claim denials, emphasizing the need for effective denial management processes. According to industry reports, up to 5% of claims can be denied initially, with a significant portion remaining unresolved without proper intervention.

Underpayments

Underpayments occur when the payment received from a payer is less than what was billed. This discrepancy can result from:

Coding Errors: Incorrect coding can lead to underpayments if the billed amount does not align with the services provided. For example, billing for a more complex procedure using a lower-level code may result in underpayment.

Payer Errors: Mistakes on the payer’s side, such as miscalculations or application of incorrect contract terms, can also result in underpayments. It is crucial to review and reconcile payment statements regularly. Underpayments, if not identified and addressed promptly, can accumulate over time, significantly impacting revenue. Regular audits and reconciliation practices can help detect and correct underpayment issues.

Delayed Payments

Delayed payments present a significant challenge to healthcare organizations’ cash flow. Common causes include:

Incomplete Information: Missing or incorrect information can delay payment processing. For instance, an incomplete claim form or missing authorization can cause processing delays.

Administrative Issues: Internal processing delays or errors, such as backlogs or inefficiencies in claim handling, can contribute to payment delays.

Payer Processing Delays: Delays on the payer’s side, such as system issues or backlog, can also impact payment timelines. Timely follow-ups and monitoring can help address these delays. Efficient follow-up and resolution processes are essential to mitigate the effects of delayed payments and ensure timely cash flow.

Rejected Claims

Rejected claims differ from denied claims in that they are returned before processing due to errors requiring correction. Common reasons include:

Clerical Errors: Simple mistakes, such as typos or incorrect dates, can result in rejection. Implementing verification processes can help reduce clerical errors.

Incorrect Diagnosis Codes: Using incorrect or outdated diagnosis codes can lead to rejections. Ensuring accurate and up-to-date coding practices is essential.

Missing Signatures: Claims lacking necessary signatures or authorizations are often rejected. Proper documentation and authorization are crucial for claim acceptance.

Although rejected claims can be corrected and resubmitted, they contribute to additional administrative work and delays in revenue. Efficient correction and resubmission processes can help minimize the impact of rejected claims.

Patient Balances

Collecting patient balances can be challenging, particularly with high-deductible health plans. Issues include:

High Deductibles: Patients with high-deductible plans may struggle to pay their portion of medical bills. Implementing financial counseling and payment plans can help manage patient balances.

Billing Discrepancies: Discrepancies between the billed amount and what the patient is responsible for can create confusion and delay payments. Clear and transparent billing practices are essential.

Lack of Point–of-Service Collections: Failing to collect payments at the time of service can result in higher outstanding balances. Implementing point-of-service collections strategies can help address patient balances promptly. Effective strategies for managing patient balances include clear communication of financial responsibilities, offering payment plans, and utilizing point-of-service collections.

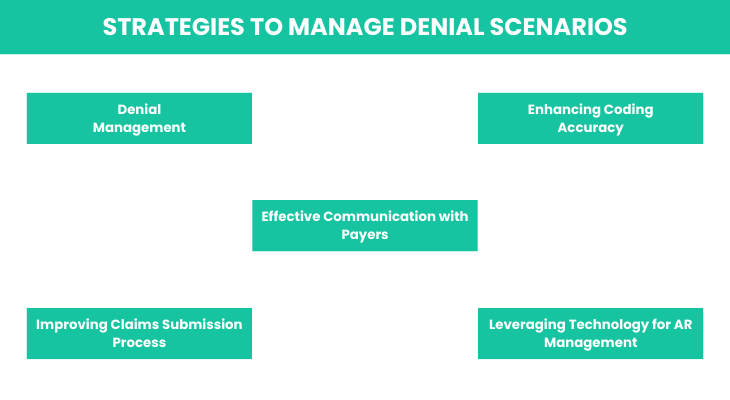

Strategies for Managing AR Denial Scenarios

Denial Management

Effective denial management is key to resolving AR denial scenarios and improving AR resolution. Steps include:

Identifying the Root Cause: Analyze denials to determine the underlying issues, such as coding errors or incomplete information. Identifying patterns can help address recurring issues.

Correcting the Issue: Address the identified problems by updating codes, providing missing information, or obtaining necessary authorizations. Ensuring accurate and complete claim submissions is crucial.

Resubmitting the Claim: Ensure that corrected claims are resubmitted promptly to avoid further delays. Timely resubmission is essential for maintaining cash flow.

Preventive Measures: Implement regular audits, staff training, and process improvements to reduce the frequency of denials. Preventive measures can help minimize the occurrence of denial scenarios. By adopting a proactive approach to denial management, healthcare organizations can enhance their revenue cycle efficiency and minimize disruptions.

Enhancing Coding Accuracy

Accurate coding is crucial to preventing denials and underpayments. Strategies include:

Utilizing Advanced Coding Tools: Implement automated coding software to ensure accurate and up-to-date coding practices. Automated tools can helps reduce errors and improve efficiency.

Ongoing Staff Training: Provide continuous education for billing and coding staff to stay current with the latest coding guidelines and regulatory changes. Regular training can enhance coding accuracy and compliance.

Regular Audits: Conduct regular audits to identify and address coding issues before claims are submitted. Audits can help detect and correct potential errors. By focusing on coding accuracy, healthcare organizations can reduce the likelihood of denials and improve claim processing efficiency.

Improving Claims Submission Process

Optimizing the claim submission process is essential for reducing errors and minimizing denials. Tips include:

Thorough Review: Implement a thorough review process to verify that all required information is included and accurate before submission. Review procedures can help identify and correct errors.

Adherence to Protocols: Follow established submission protocols and guidelines to avoid common mistakes and ensure compliance. Adherence to protocols can reduce the risk of errors.

Checklists: Use checklists to ensure that all necessary details are included, reducing the risk of errors and rejections. Checklists can improve accuracy and efficiency.

Timely Follow-Up: Address any issues or rejections promptly to avoid further delays in the revenue cycle. Timely follow-up is crucial for maintaining cash flow. By refining the claims submission process, healthcare organizations can enhance efficiency and reduce the incidence of claim denials.

Effective Communication with Payers

Maintaining clear and effective communication with insurance companies is crucial for managing denied claims. Best practices include:

Regular Monitoring: Use Key Performance Indicators (KPIs) to track payer performance and identify trends in denials. KPIs can provide insights into payer performance and denial patterns.

Building Relationships: Establish strong relationships with payer representatives to facilitate smoother resolution of denied claims. Building relationships can enhance communication and collaboration.

Negotiating and Appealing: Develop strategies for negotiating and appealing denied claims to achieve favorable outcomes. Effective negotiation and appeal processes can improve claim resolution.

Documentation: Keep detailed records of communications and resolutions to support future claims and appeals. Proper documentation can aid in resolving disputes and ensuring accurate claim processing. Effective communication can lead to quicker resolutions, better payer relations, and improved AR management.

Leveraging Technology for AR Management

Advanced software solutions can significantly enhance AR management and denial tracking. Benefits include:

Automation: Automate the billing process to reduce manual errors and improve efficiency. Automation can streamline workflows and enhance accuracy.

Denial Tracking: Use technology to track and analyze denial patterns, enabling targeted interventions and improvements. Denial tracking can help identify and address recurring issues.

Case Studies: Successful examples of AR management through technology include organizations that have reduced denial rates and accelerated claim resolutions by implementing advanced software solutions.

Case studies can provide insights into effective AR management practices. By leveraging technology, healthcare organizations can streamline their billing processes, reduce errors, and improve overall AR management.

Conclusion

Managing AR denial scenarios is essential for maintaining a healthy revenue cycle in healthcare organizations. By understanding common denial scenarios and implementing effective strategies—such as enhancing coding accuracy, improving the claims submission process, and leveraging technology—healthcare providers can reduce denials, improve AR resolution, and enhance their financial performance. A proactive approach to AR management not only improves operational efficiency but also contributes to better patient satisfaction and overall organizational success. Embracing these strategies and continuously refining AR management practices will lead to a more resilient and efficient revenue cycle, ultimately supporting the long-term success of healthcare organizations.

How ProMantra Can Help

At ProMantra, we understand the complexities of AR denial scenarios and offer tailored solutions to streamline your revenue cycle management. Our comprehensive services include advanced denial management strategies, coding accuracy enhancements, and technology solutions designed to optimize your billing processes.

With our expertise, we can help you identify and resolve denial issues efficiently, improve your claims submission process, and leverage cutting-edge technology to track and manage AR effectively. By partnering with ProMantra, healthcare organizations can reduce denial rates, improve cash flow, and enhance overall financial performance. Explore how our specialized services can transform your AR management and support your organization’s success at ProMantra.