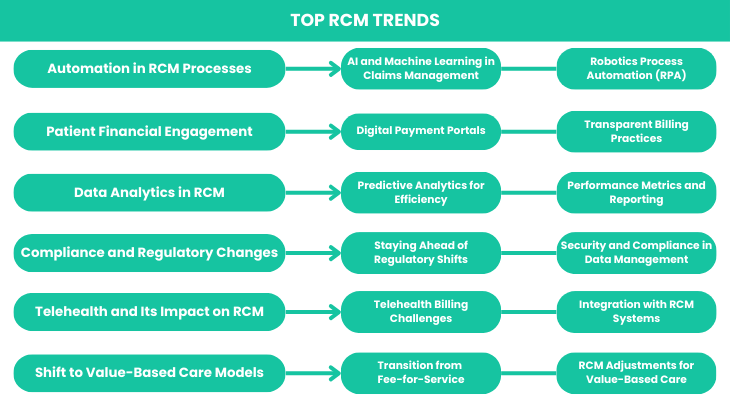

The healthcare industry is experiencing a wave of change, particularly in revenue cycle management (RCM). As we advance through 2024, it’s essential to grasp the trends revolutionizing RCM practices. These trends are not only enhancing efficiency but also shifting the focus towards a more patient-centric approach. Let’s explore the transformative RCM trends that are shaping the future of healthcare.

Without further ado, let’s jumbo into our picks of the top RCM trends currently reshaping healthcare.

Automation is revolutionizing RCM by streamlining numerous processes and reducing the risk of human error. With automation, routine tasks such as claim submissions and payment processing can be completed swiftly and accurately. This technology minimizes manual intervention, allowing healthcare organizations to allocate resources more effectively.

Automating administrative tasks also means faster processing times and improved accuracy of financial data. This, in turn, leads to better decision-making and optimized revenue cycles.

Artificial Intelligence (AI) and machine learning are making a significant impact on claims management. These technologies sift through massive datasets to detect patterns and anticipate potential issues before they become problems. AI can, for instance, identify claims that are at high risk of denial, enabling proactive corrections that enhance approval rates.

Moreover, machine learning is improving fraud detection. By analyzing historical data, AI systems can recognize unusual activity that may indicate fraud, helping to safeguard financial resources and adhere to regulatory requirements.

Robotic Process Automation (RPA) is another trend driving change in RCM. RPA utilizes software robots to handle repetitive tasks such as data entry and verification with high accuracy. This reduces the need for human oversight in routine activities, freeing staff to focus on more complex issues.

RPA streamlines processes like verifying patient eligibility and managing claim denials, resulting in faster, more efficient operations with fewer errors.

As healthcare costs rise, patient financial engagement is becoming increasingly important. Patients are more involved in managing their healthcare expenses, and organizations are responding by enhancing engagement strategies.

Effective patient engagement involves clear communication about costs and payment options. Providing transparent information and user-friendly tools helps patients understand their financial responsibilities and reduces the likelihood of unpaid bills.

Digital payment portals are transforming patient interactions with healthcare providers. These platforms enable patients to view bills, make payments, and track their financial transactions online. The convenience of digital payments boosts patient satisfaction and accelerates revenue collection.

Offering digital payment options not only enhances patient experience but also improves the efficiency of the revenue cycle by reducing processing times and automating payment reminders.

Transparency in billing is becoming a key factor in patient trust and satisfaction. Patients demand clear, understandable billing statements, and healthcare providers are adopting transparent practices to meet these expectations.

Transparent billing involves detailed explanations of charges, itemized service lists, and straightforward communication about costs. By implementing these practices, healthcare organizations can build trust, reduce disputes, and enhance overall revenue cycle performance.

Data analytics is reshaping RCM by providing deep insights into financial operations. Advanced analytics tools allow organizations to identify trends, make data-driven decisions, and optimize revenue cycles.

Predictive analytics, for example, helps forecast future revenue and identify potential issues early. This proactive approach enables organizations to address challenges before they impact financial performance.

Predictive analytics offers valuable foresight into future trends and challenges. By examining historical data and identifying patterns, predictive analytics can project revenue trends, patient payment behaviors, and claim approval rates.

This insight allows healthcare organizations to make informed decisions regarding resource allocation and billing practices, leading to a more efficient revenue cycle.

Performance metrics and reporting are critical for managing and improving the revenue cycle. Tracking key indicators such as days in accounts receivable and claim denial rates provides valuable insights into financial performance.

Regular reporting helps evaluate the effectiveness of revenue cycle processes and guides data-driven improvements. This continuous monitoring ensures better financial outcomes and more effective revenue management.

Adapting to regulatory changes is crucial for effective revenue cycle management. Healthcare organizations must update billing and coding practices to comply with evolving regulations.

Staying ahead of regulatory shifts involves keeping up with new guidelines, providing staff training, and making necessary adjustments to systems and processes. Proactively managing these changes helps avoid penalties and ensures a smooth revenue cycle.

Navigating the dynamic regulatory environment requires proactive strategies. Organizations must stay informed about upcoming changes, invest in staff education, and update their practices to remain compliant.

By anticipating regulatory shifts, healthcare providers can minimize disruptions, ensure compliance, and maintain financial stability. This proactive approach also reflects a commitment to ethical practices and high-quality patient care.

Ensuring the security and compliance of patient data is essential in the digital age. Data breaches and compliance issues can have serious financial and reputational consequences.

Implementing robust security measures, such as encryption and strict access controls, protects sensitive information. Regular audits and compliance checks also ensure adherence to regulations and industry standards.

The rise of telehealth is significantly impacting revenue cycle management. As virtual consultations become more common, managing the financial aspects of these services introduces new challenges.

Accurate billing for telehealth services requires proper coding and documentation. Additionally, integrating telehealth with existing RCM systems is crucial for maintaining a cohesive revenue cycle. Addressing these challenges involves updating billing practices and leveraging technology for seamless telehealth billing.

Billing for telehealth services presents unique challenges, including coding for virtual visits and managing reimbursement rates. Understanding payer requirements and ensuring accurate documentation are essential for effective telehealth billing.

Navigating different reimbursement policies for telehealth services, which can vary by payer and location, is crucial for optimizing revenue collection. Staying informed and adapting billing practices to these policies is key to managing telehealth billing effectively.

Integrating telehealth services with RCM systems ensures that virtual visits are accurately captured and processed alongside in-person services. This integration streamlines processes, reduces errors, and improves financial performance.

A unified RCM system that supports both telehealth and in-person services provides a comprehensive view of revenue cycle data, enhancing overall management and efficiency.

The shift from fee-for-service to value-based care models is a major trend in healthcare. Value-based care focuses on improving patient outcomes and overall value rather than just providing more services.

This shift requires adjustments to RCM practices, including changes to billing processes and performance metrics. Aligning RCM practices with value-based care goals helps healthcare organizations enhance care quality and financial performance.

Transitioning from fee-for-service to value-based care presents both opportunities and challenges. Healthcare organizations must adjust their RCM practices to align with new reimbursement models that emphasize patient outcomes and cost efficiency.

Updating billing practices, implementing new performance measures, and enhancing patient engagement strategies are crucial for success in a value-based care environment.

Adapting RCM practices for value-based care involves several key adjustments:

By making these adjustments, healthcare organizations can optimize their revenue cycles and achieve better outcomes in a value-based care setting.

The trends reshaping revenue cycle management are driving significant changes in healthcare. From automation and AI to telehealth and value-based care, these trends are enhancing efficiency and focusing on patient-centered approaches.

Understanding and adapting to these trends will enable healthcare organizations to navigate the complexities of modern RCM effectively. Embracing these changes not only positions organizations for success but also contributes to a more efficient and patient-focused healthcare system.

For expert guidance on navigating these RCM trends, ProMantra offers tailored solutions to optimize your revenue cycle management practices. Reach out to us to discover how we can help you stay ahead in this evolving healthcare landscape.